Analyzing Biodiversity in

Global Fixed Income Portfolios

WRITTEN BY

Heather Ridill, CFA

Global Credit Portfolio Manager

Biodiversity is an emerging, and increasingly important, issue for managers to consider in investment management.

To date, we have found that due to limited data, tools and knowledge, the integration of biodiversity factors in investment research remains limited. Within the investment community, calls are growing to measure the impact and dependencies on biodiversity in portfolios. Market participants appear to be recognizing the importance and magnitude of potential risks and opportunities at play.

Note: in this paper, a follow-up to Biodiversity: The Nature of Investing, we discuss:

1. analytical tools - data, engagement and opportunities; and,

2. biodiversity investment factors in global bond management - financial materiality, progress tracking, investment opportunities and fixed income hurdles.

Analytical Tools

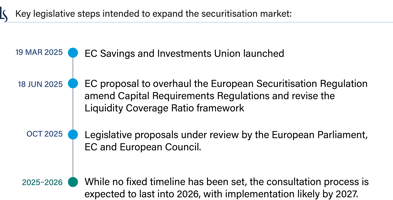

While company-reported biodiversity data remains limited, there has been a significant increase in tools to measure biodiversity footprints and exposures. We believe the best path at present is combining three distinct research avenues to try and create a complete picture.

Source: Loomis Sayles.

While the majority of tools discussed are corporate-focused, country data is at the heart of them and critical to the analysis. As a result, we believe that these tools can also be used for credit and sovereign analysis, especially with biodiversity footprinting and location data.

DATA

While the list of tools and models available to assess the impact on biodiversity from a portfolio continues to grow, the main limiting factor today is the lack of available data from companies on the actual impacts on biodiversity. According to Sustainalytics, only 32% of US companies report on material biodiversity issues and even fewer take internal actions to protect against them.3 As a result, investors have to rely heavily on models that, in some cases, lack a robust relationship between the pressure and impact.

We have learned that many companies do not have data on the sources and locations of raw materials across their value chains, which is critical information for a full assessment of a company’s biodiversity. For example, according to MSCI, only 10% of packaged food companies that derive more than 20% of sales from products that rely on palm oil, beef or dairy products can trace at least one-third of their supply chain back to the farm level.4

There is reason to be hopeful that the Taskforce on Nature-related Financial Disclosures (see below: What Can Enhance Tool Effectiveness?) can help encourage the closing of this information and data gap as the Taskforce on Climate-related Financial Disclosure did for climate data. However, it will take time—and engagement.

What Can Enhance Tool Effectiveness?

Senior executives from financial institutions, corporations and market service providers established the Taskforce on Nature-related Financial Disclosures (TNFD) recognizing that nature should be factored into financial and business decisions.5 TNFD is billed as the biodiversity-equivalent of the influential Taskforce on Climate-related Financial Disclosure (TCFD) and aims to replicate the success of the TCFD’s recommendation in driving global climate reporting.

TNFD strives to encourage corporates and financial institutions to better understand, assess, manage and report on their dependencies and impacts on nature. TNFD seeks to align with the UN Convention on Biological Diversity’s post-2020 Global Biodiversity Framework of “zero net loss of nature” from 2020, “net positive” by 2030 and a full recovery of nature by 2050. Ultimately, TNFD aims to redirect global financial flows away from activities that harm nature and to activities that benefit nature in order to align with these goals. TNFD mimics TCFD in that it has the same four pillars: governance, strategy, risk management, and metrics and targets. Additionally, due to the complexity of nature-specific reporting, there will also be sector-specific recommended disclosures and guidance. The risk and assessment process is being called LEAP, where the steps are: locate your interface with nature, evaluate your dependencies and impacts, assess your risks and opportunities and prepare to respond to nature-related risks and opportunities and report to investors. The final framework was recently released.6

ENGAGEMENT

Engagement between corporations and investors on supply chains and direct impacts is key. In our opinion, obtaining actionable data will often require intensive communication. Analysts can engage with companies to encourage them to assess the biodiversity impacts across their value chains. Alternatively, analysts can encourage companies to implement mitigation targets using science-based frameworks, identify multistep processes for achieving progress, and demonstrate senior management commitment to biodiversity education and adherence to biodiversity governance.

OPPORTUNITIES

We view the opportunities side of the equation as another area with limited attention thus far that should be incorporated into balanced portfolio analysis. Similar to climate change, most of the tools and focus is on the risks presented by the damage being done to biodiversity. However, there are solution providers and companies positioned to benefit from biodiversity conservation, both absolute and relative to peers. We believe that by ignoring these opportunities in an analysis, one could be missing out on potential alpha opportunities. As a result, more tools and research are needed on which companies may be best positioned with regard to impacts and dependencies on biodiversity as well as which companies have the potential to be solutions providers for biodiversity conservation.

Biodiversity Investment Risks and Opportunities in Global Bond Portfolios

It is early days in the evolution of biodiversity analysis in portfolio management. In our view, this does not mean investors should not be aware of where biodiversity-related risks and opportunities lie within portfolios. There are a number of high-level steps that can be taken to start. As we discussed in our first paper, it’s important to identify the industry and country exposures in a portfolio that have high dependencies and impacts on biodiversity. At the country level, identifying the overlap of country exposures with “hotspots” is a good first step in understanding how susceptible countries are to biodiversity-related

risks. In our opinion, understanding the intersection of hotspots and countries at risk with the entire value chains of corporate holdings, is an ultimate goal.

FINANCIAL MATERIALITY

It is important to understand the materiality of the risks facing a portfolio in order to determine how best to weigh them during decision making and how much one should be compensated for those potential risks. In our view, industries with high dependencies require investors to look at the location of these dependencies. This should reveal the risk level issuers are facing. For example, if an issuer is significantly dependent on water and they operate in India, where water scarcity is a major issue, it’s a much more significant risk than if they operate in the US Midwest, where water is generally more plentiful.

We also find that for industries with high impacts, analysts need to also assess the locations to determine how material it could be to that ecosystem, and in turn, the risk to the business from that impact. For example, polluting water in a hotspot in danger of water depletion is going to gain more attention and ultimately risk for the business.

As mentioned earlier, engagement can be a critical tool, especially with issuers in high dependency/impact industries. We believe that by engaging with issuers, investors can encourage them to improve their reporting to allow for a deeper understanding of the materiality and timelines of the risks, biodiversity target setting and mitigation efforts.

PROGRESS TRACKING

Ultimately, target setting at the portfolio level is likely to play a role in forward-looking management of biodiversity risks, in our view. While the ability to set targets today is limited, there are a few ways this could be managed with targets evolving over time with data allowance. For example, setting targets for:

- improvement on high priority industries,

- aligning United Nations Sustainability Development Goals (SDG) with a percentage of a portfolio,

- a percentage of issuers to have biodiversity targets and

- using biodiversity footprinting.

INVESTMENT OPPORTUNITIES

There are companies and industries that contribute to biodiversity resilience and provide net positive nature solutions that could be attractive investment opportunities. Nature-related opportunities arise from resource efficiency, new products and services, green financing vehicles, company resilience through diversification and new activities and reputational benefits from positive proactive risk management. We find that it is important to understand who these issuers are within an opportunity set in order to take a potential upside opportunity into account when making investment decisions. As this data becomes available, another portfolio-level target could aim for a portfolio percentage to include biodiversity solutions providers.

FIXED INCOME HURDLES

Bond investors have two other specific concepts to grapple with—time to maturity and primary issuance. A bond’s maturity and the timeline for biodiversity issues to impact valuations can be misaligned. Consider a 10-year bond issued by a company or country where there is an expectation for a partial, but material, ecosystem collapse in 20 years. In such a case, there can be a lower incentive for investors to manage portfolios with regard to biodiversity concerns. It comes down to the time horizon.

While academics and scientists can estimate the value of biodiversity, determining when that value will be destroyed is much harder. Taking an investor’s view, it’s important to take into account material financial risks in decision making, and while a long time horizon can imply a lower materiality, the high value of biodiversity also implies that it needs to have some materiality in

risk assessment, in our view. As a result, some compensation in valuation should be included to compensate for this tail risk, in our opinion. Current market valuations of bonds do not capture this biodiversity tail risk.

The Intersection of Climate Change and Biodiversity

There is an important connection between climate change and biodiversity. Changes in each have the potential to influence the other. Climate mitigation and adaptation solutions can have harmful impacts on biodiversity (solar panels, wind turbines), though biodiversity conservation solutions are generally positive from a climate change perspective.

According to the International Union for Conservation of Nature, the destruction of biodiversity is further harming nature’s ability to absorb greenhouse gasses. If actions were taken to restore and protect biodiversity, they could contribute to a third of the cuts in greenhouse gas emissions needed to meet the Paris agreement.8 In 2021, 7% of the European Union’s emissions were removed by forests, but biodiversity loss is rapidly shrinking forests and other natural elements that absorb carbon.9

The close link between climate risks and biodiversity encourage the concurrent analysis of the risks and opportunities. Climate change mitigation and adaptation solutions are often the first decision factor for companies, but they need to consider the impact these solutions have on nature.

TNFD’s creation and close collaboration with TCFD acknowledges the inseparable feedback loops between climate and nature and the importance of an integrated approach.10 Natural resources can also help to provide effective and efficient climate change adaptation solutions. Mangroves, for example, are a critical biome for limiting the impacts of climate change through floods and storms. Nature-based carbon offsets are of growing importance to many companies’ net zero targets with one third of carbon offsets issued linked to planting or preserving forests.11

We believe that the interdependence between biodiversity and climate change is important to recognize and account for when analyzing portfolio exposures as well as when engaging with corporations on either topic.

As the market eventually gains a better understanding of these risks, they will likely be priced in. We believe that analysts and portfolio managers armed with knowledge regarding the potential threat of biodiversity to a bond’s valuation can be positioned to help generate alpha within a portfolio.

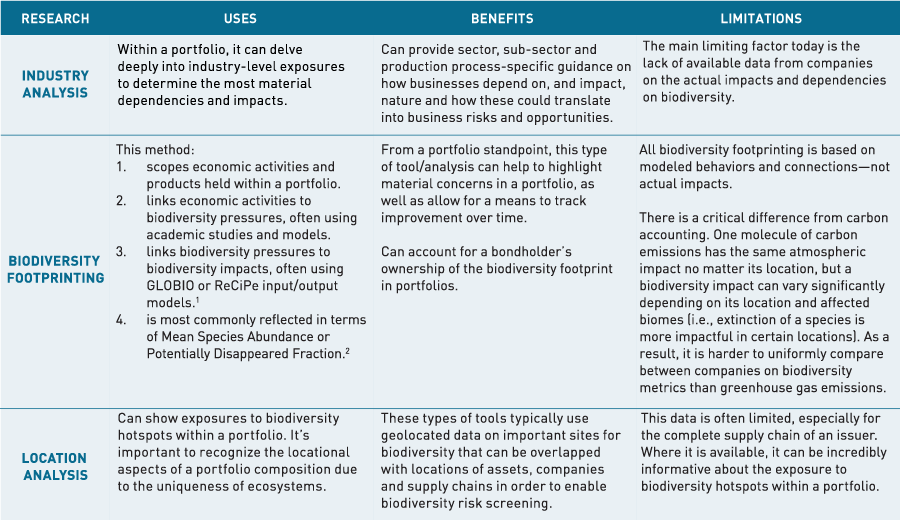

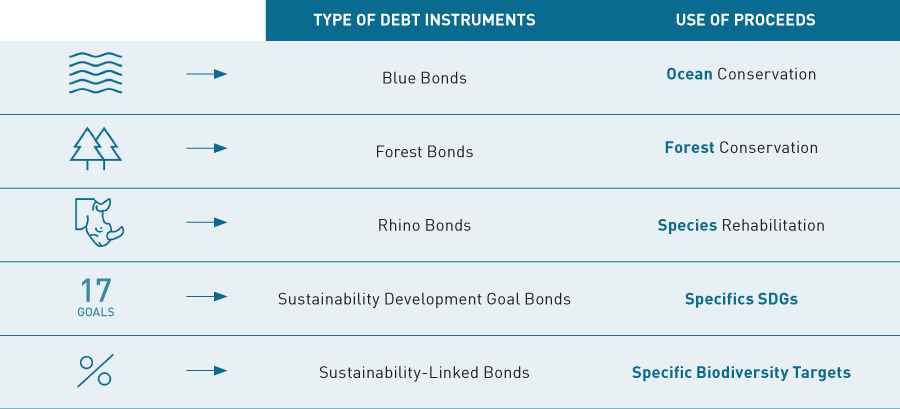

The other concept worth exploring from a bond investor’s perspective is the primary issuance market. Primary issuance can be used by issuers to fund everything from general corporate purposes to acquisitions and specific projects. Investors are provided with information on how the proceeds of the bond issuance will be used, sometimes with more detail and other times with less, and this can provide an opportunity for investors to actively participate in or avoid certain industries, issuers or projects that would have a material negative impact on biodiversity. The environmental, social and governance (ESG) bond

market has grown tremendously during the past few years.12 While the majority of structures are focused on climate change, there are new and growing avenues for biodiversity-focused investing (see table below). ESG-labeled bonds are a potential solution to conservation funding and a means for investors to encourage biodiversity conservation.

Source: Loomis Sayles. The chart presented above is shown for illustrative purposes only. Information on this chart should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio.

Conclusion

As we have demonstrated in our papers, global bond investors can’t ignore biodiversity’s important role in the broad economy. While materiality, timelines and impact on valuations can be debated, an investor has to understand where the dependencies and impacts in a portfolio lie in order to have a fruitful discussion. As data and disclosures evolve, the linkages between nature and financial value are likely to become more apparent and priced into valuations, in our view. As a result, staying ahead of the curve on understanding and analyzing biodiversity exposures in a portfolio has the potential to help drive alpha generation. Taking that a step further, by engaging with companies to push for improvement in biodiversity practices, as well as setting portfolio-level targets for improvement, global bond portfolios can help to be a driver of positive change in the biodiversity landscape; over time, we believe that can drive improved risk-adjusted returns.

Author

Heather Ridill, CFA

Global Credit Portfolio Manager

Endnotes

1 The GLOBIO model calculates the impacts of anthropogenic pressures on biodiversity based on scientifically supported dose-response relationships. The model is respected for the breadth of pressures it considers, which includes infrastructure, hunting, nitrogen deposition, habitat fragmentation, land-use and climate change. Similarly, the ReCiPe model calculates the effects on ecosystem quality from pressures, including emissions, resource extractions, damage to human health and resource scarcity.

2 Mean Species Abundance measures the intactness of a species by comparing actual abundance of a species in a given ecosystem to their estimated abundance if the ecosystem was in an undisturbed state. Potentially Disappeared Fraction measures intactness of a species by estimating the percentage of species lost in one year in a specific area due to environmental pressures.

3 Sustainalytics, 2021, most recent available.

4 MSCI, 2022.

5 The Taskforce consists of 40 individuals representing financial institutions, corporates and market service providers with over $20 trillion in assets. The members represent sectors with the largest impacts and dependencies on nature, including agribusiness, the blue economy, food & beverage, mining,

construction, infrastructure and more. The global group represents 18 countries, across 5 continents.

6 KPMG, 2022.

7 Source: UN Environment Programme- World Conservation Monitoring Centre, 2020; Seretis, 2021.

8 UN https://www.un.org/en/climatechange/science/climate-issues/biodiversity

9 https://cbmjournal.biomedcentral.com/articles/10.1186/s13021-023-00234-0

10 KMPG, 2022.

11 MSCI, 2022.

12 Source: The World Bank, as of 8 November 2022.

Disclosure

This paper is provided for informational purposes only and should not be construed as investment advice. Opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Other industry analysts and investment personnel may have different views and opinions. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted, and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Market conditions are extremely fluid and change frequently.

Past performance is no guarantee of, and not necessarily indicative of, future results.

LS Loomis | Sayles is a trademark of Loomis, Sayles & Company, L.P. registered in the US Patent and Trademark Office

MALR032141