We develop individual solutions for you based on cutting-edge financial engineering, proprietary risk management systems and higher execution.

Seeking to solve complex allocation problems with flexible modeling driven by powerful optimization algorithms.

REGIME IDENTIFICATION + INPUTS + CONSTRUCTION = SOLUTIONS

Fundamental, market-based, systematic, forward-looking, machine learning

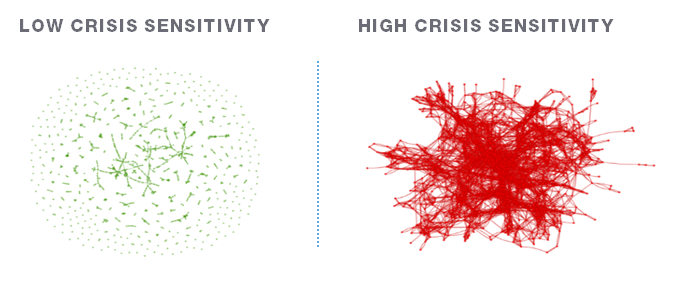

We have individual regimes per risk factor. It is a differentiator.

For illustrative purposes only.

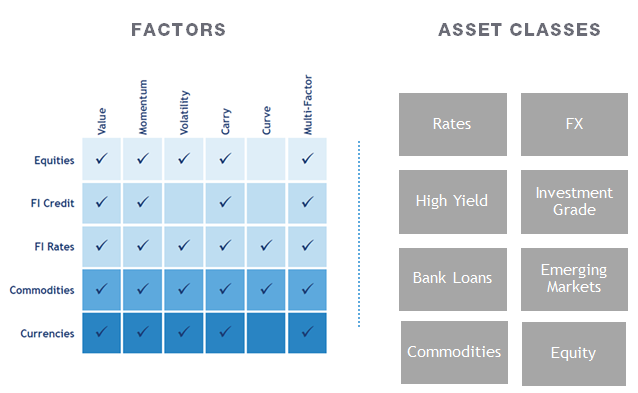

Factors + Asset Classes

Inputs include individual factors, multi-factors or using factors in conjunction with standard asset classes offering over 100,000+ possible solutions for our clients.

For illustrative purposes only.

Can provide a stable medium with low turnover.

Regime detection, optimization & risk management are key to constructing products & solutions.

For illustrative purposes only.

Our strategies and capabilities can create customized solutions for you.

Index

Capabilities

Our investors are watching how monetary policy, consumer health, earnings and profits will come together to drive the cycle and asset markets.

Several of our fixed income portfolio managers share unexpected developments that have shaped their view of the credit markets.

The agility of central banks is currently being put to the test. Charged with managing inflation and supporting full employment, the Federal Reserve and other global central banks are confronting rising inflation expectations and multiple supply shocks that are undermining the outlook for economic growth potential.

We have seen an extension of the US dollar bull market as global central banks move forward with quantitative tightening against a backdrop of weakening global growth and rising late-cycle risks.

To make the best decisions, investors need a clear view of the road ahead. Watch to see how LASER can help you to stop looking only in the rear-view mirror.

Watch VideoIt can be difficult to give a fair representation of each country’s market response to the COVID-19 outbreak. How can one measure a country’s response under these circumstances? We believe high-frequency data can offer some answers.

Read MoreWhen storage capacity is near its limits, how do oil producers offload their inventory? One way is to incentivize buyers with negative prices.

Read MoreOur research analyzes the stalking pattern observed in the stock market network to identify crisis periods.

Read MoreOver the long term, we should be mindful of the next phase of the credit cycle.

WatchA multi-asset credit strategy is a diversified strategy that seeks attractive global credit risk premia in different credit sectors as well as different credit asset classes.

WatchIncome is a key ingredient of long-term total return potential, but not all income is created equal. How can investors harvest the right opportunities?

WatchWe believe investors should consider multi-asset credit strategies for diversified income sources and attractive.

Read MoreEmerging market (EM) assets were hit hard by the crash in commodity prices in 2014-2015, but so far this year, EM and commodity performance have diverged.

Read MoreGlobal credit and equity markets have outperformed the US so far this year. Will this growth trend continue for the rest of the year?

Read MoreWe have seen an extension of the US dollar bull market as global central banks move forward with quantitative tightening against a backdrop of weakening global growth and rising late-cycle risks.

Read MoreWe believe top-down regimes drive risk appetite and performance in emerging markets. Watch to learn more from our Alpha Strategies team.

WatchReal rates in the United States have moved sharply higher since the beginning of 2021. The move has many wondering if emerging market (EM) assets are vulnerable to a repeat of the 2013 “taper tantrum.”

Read MoreThe faces behind Alpha Strategies

Kevin Kearns is a portfolio manager and head of the alpha strategies group at Loomis, Sayles & Company. He co-manages the Loomis Sayles multi-asset credit and income strategies and custom strategies, as well as the Loomis Sayles

Inflation Protected Securities Fund. Kevin has 38 years of investment industry experience and joined Loomis Sayles in 2007.

Andrea DiCenso is a co-portfolio manager at Loomis, Sayles & Company, where she co-manages the multi-asset credit and emerging markets debt blended total return strategies. She is also a senior strategist for the alpha strategies group and oversees all FX and commodity activity for the firm's multi-asset product suite, and is primarily responsible for asset allocation, idea generation, portfolio construction and risk management.

Vivek Gargis a portfolio manager at Loomis, Sayles & Company. He is responsible for managing various equity strategies for the alpha strategies group. Vivek is also the lead convertible bonds and equity option strategist for the platform. He has over 16 years of investment industry experience. Vivek is a CFA® charterholder.

Elaine Kan is a portfolio manager and rate & currency strategist for the fixed income group at Loomis, Sayles & Company. In addition to co-managing the Loomis Sayles Inflation Protected Securities Fund, 1290 Loomis Sayles Multi-Asset Income Fund and Natixis Loomis Sayles Global Multi Asset Income Fund, Elaine is responsible for implementing interest rates and currency derivatives strategies for the alpha strategies group, as well as providing support to other products across the fixed income group. She is a CFA® charterholder.

Mark LaRochelle is an associate portfolio manager for the credit asset strategy at Loomis, Sayles & Company. In addition, he is an investment strategist for the alpha strategies group. Mark joined Loomis Sayles in 2000 and has 27 years of investment industry experience. He is a CFA® charterholder.

Tom Stolberg is a co-portfolio manager at Loomis, Sayles & Company for the Loomis Sayles multi-asset credit strategies. He has 30 years of investment industry experience and joined Loomis Sayles in 2008. Tom is a CFA® charterholder.

Harish Sundaresh is a portfolio manager at Loomis, Sayles & Company. As director of the firm’s systematic investing strategies team, he leads a team responsible for quantitative investing across all asset classes using advanced mathematical techniques. This includes alpha generation, dynamic portfolio construction and solutions development.

Diqing Wu is a senior quantitative analyst in the systematic investing strategies team at Loomis,Sayles & Company, where he is responsible for developing and implementing quantitative strategies in the multi-asset space. He is a CFA® charterholder.

Peter Yanulis is a co-portfolio manager for the emerging market debt blended total return strategy and an associate portfolio manager for the world credit asset strategy at Loomis, Sayles & Company. In addition, he is also a multi-asset credit strategist for the alpha strategies group, focusing primarily on global emerging markets, portfolio construction and risk premia. Peter joined Loomis Sayles in 2015 as a research analyst covering emerging market sovereigns, and has 17 years of investment industry experience.

Kairui Huo is a senior investment analyst for the alpha strategies group at Loomis,

Sayles & Company. He is responsible for conducting quantitative research on fixed

income sectors to explore alpha-added factors and assisting with the construction

of fixed income portfolios that maximize return potential.

Xian Li is a quantitative analyst in the systematic investing strategies team at Loomis, Sayles & Company, where he is responsible for researching, developing and maintaining systematic strategies in the multi-asset space. He is a CFA® charterholder.

David Liu is an investment strategist for the alpha strategies group at Loomis, Sayles & Company. He joined Loomis Sayles in 2020 and has 10 years of investment industry experience. David is a CFA® charterholder.

Tian Qiu is an investment analyst for the alpha strategies group at Loomis, Sayles & Company. In this role, he is responsible for developing and implementing multi-asset quantitative strategies and analytics, focusing primarily on global emerging markets, currency strategies, ESG and sustainable investment, portfolio construction, asset allocation and risk management. Tian joined Loomis Sayles in 2019 and has 11 years of investment industry experience.

Question not answered yet? We'd love to hear from you.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

Client concerns are shown for illustrative purposes only. Although they are representative of client feedback, they are

not intended as direct quotes.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Investment decisions should consider the individual circumstances of the particular investor. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but we cannot guarantee its accuracy. This information is subject to change at any time without notice.

The charts presented above are shown for illustrative purposes only. Some or all of the information on these charts may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio.

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product.

Any investment that has the possibility for profits also has the possibility of losses.

There is no guarantee that the investment objective will be realized or that the strategy will generate positive or excess return.

MALR031853

Loomis, Sayles & Company, L.P. | One Financial Center, Boston, MA 02111 | 800.343.2029

Sitemap | Privacy Policy | Cookie Policy | Important Information