Straight Talk for Strange Times:

Fixed Income Experts Weigh In

We gathered leaders from across Loomis Sayles to hear their takes on some of the biggest questions weighing on the market. These candid discussions explore global relationships, flight-to-quality strategies, and sources of growth and diversification in this volatile environment.

The New World Order

Major shifts in world leadership, global trade, and geopolitical dynamics may have introduced a new world order. David Rolley, Global Fixed Income Portfolio Manager, Hassan Malik, Global Macro Strategist and Sovereign Portfolio Manager, and Matt Eagan, Portfolio Manager and Head of Full Discretion share their takes on the impact of these shifts on markets and central banks.

Matt Egan

Portfolio Manager

David Rolley, CFA

Portfolio Manager, Co-Head of Global Fixed Income Team

Hassan Malik

Global Macro Strategist and Sovereign Portfolio Manager

Matt Eagan, CFA

Matt Eagan, CFA

Matt Eagan, CFA

The New World Order

Major shifts in world leadership, global trade, and geopolitical dynamics may have introduced a new world order. David Rolley, Global Fixed Income Portfolio Manager, Hassan Malik, Global Macro Strategist and Sovereign Portfolio Manager, and Matt Eagan, Portfolio Manager and Head of Full Discretion share their takes on the impact of these shifts on markets and central banks.

-

Session One: The New World Order

-

Introduction

-

Q: For the bulk of this year, we've seen investors shrug off big geopolitical headlines and a lot of uncertainty and risk. What's your take on that?

-

Q: Let’s shift to the policy front. Investors are waiting for tariffs and budget provisions to show up in economic data. If you're a central banker, how hard is your job right now?

-

Q: Is there anything you feel optimistic about in this reshuffled world order?

-

Session Two: What Does “Flight to Quality” Mean in 2025?

-

Introduction

-

Q: Has the flight to quality playbook changed?

-

Q: Do you think more fiscal spending globally will change the way investors approach the long end of the yield curve?

-

Session Three: Where’s the Growth?

-

Introduction

-

Q: We’ve seen our fair share of uncertainty and major policy decisions in 2025. Do you see any relative country or industry beneficiaries in the landscape?

-

Q: Do you think now is a good time to diversify away from the US?

-

Q: Let's talk about layering in your day job. How are you putting fixed income assets to work in this environment?

Session One - The New World Order

Introduction

Major shifts in world leadership, global trade and geopolitical dynamics may have introduced a new world order. David Rolley, CFA, Global Fixed Income Portfolio Manager, Hassan Malik, PhD, CFA, Global Macro Strategist and Sovereign Portfolio Manager, and Matt Eagan, CFA, Portfolio Manager and Head of Full Discretion, share their views on the impact of these shifts on markets and central banks.

Q: For the bulk of this year, we've seen investors shrug off big geopolitical headlines and a lot of uncertainty and risk. What's your take on that?

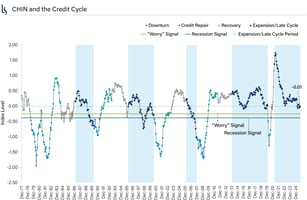

David Rolley: I would separate market risk appetite and the four different markets: equities (and I’m talking about US equities here), credit spreads, Treasurys and the US dollar. From what I see, stocks and credit spreads couldn't look more relaxed. Equities are around all-time highs. Credit spreads are tight. The signal in those markets suggests that the US is still exceptional. But the dollar has been acting like there's something new and bad here. And while Treasurys have been performing similarly to credit in recent months, Treasurys underwent a structure break after "Liberation Day" in April.i Fed funds futures went down, but Treasurys didn’t follow—they gapped about 50 basis points wider. That was structurally different from the past three years; I see a risk premium in Treasurys that was not there before. The dollar has stabilized a bit, but it’s had its worst year since 1973. You’ve got a tale of two markets here.

Source: Bloomberg, as of 26 August 2025.

Source: Bloomberg, as of 26 August 2025.

The chart presented above is shown for illustrative purposes only. Some or all of the information shown may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles.

Hassan Malik: Picking up on those points, if you take a historical perspective, I worry this period may be similar to the decades leading up to World War I. Between 1871 and 1914, you had a series of geopolitical flareups and there was this looming concern of could we break out into world war? Could we not? For investors during those 40 years, if you sold, you basically left money on the table. So the move was to keep leaning in and collecting carry, until it wasn't. In 1914, it all went off the rails. That's the analogy I worry about. To David's point, the dollar, the yield curve, and gold have been pricing in more risk. But I think other markets are asleep at the wheel. In my view, some recent geopolitical developments represent serious norms violated. We've had Russia’s war against Ukraine and many layers of Middle Eastern conflict, including things that were previously unthinkable. I wonder if we are in a moment where we just haven't yet seen the big leg down, but a lot of setups have occurred.

Matt Eagan: I don't think the bond markets are pricing in some of the geopolitical scenarios that could play out. If you look out longer on the curve, the term structure is increasing (depending on the measure), but it could rise a lot more. Historically, it has been much higher. There's a whole population of investors that have only known the market since the global financial crisis. And I think we're in the beginning stages of a new regime that people are just now getting their heads around.

Q: Let’s shift to the policy front. Investors are waiting for tariffs and budget provisions to show up in economic data. If you're a central banker, how hard is your job right now?

Matt: The Federal Reserve (Fed) today is under an onslaught, and they’re trying to preserve their credibility and being vigilant about possible inflation. But I think the bigger risk to the Fed is this increase in the deficit and the ongoing level of issuance, especially pushing it into the front end of the curve. There are risks associated with the Treasury pushing T-bills to a greater percentage of its outstanding debt. What happens every time the Fed needs to raise rates? It introduces that fiscal dominance concept, which I think is the biggest risk that the financial markets face right now, because everything is priced off of Treasurys.

Hassan: What Matt's talking about, if we think about it mechanically—the US fiscal situation is ballooning and risks to growth are potentially to the downside over the medium term, even if there's a short-term sugar rush. So now the Treasury’s issuing more and more debt, and presumably credit investors will demand some sort of spread to Treasurys. I believe that at some point, higher and higher yields and wider and wider deficits will feed on themselves.

David: One of the things you watch is inflation expectations. There's a Federal Reserve Bank of New York series on five-year forward inflation. And that number is not showing any stress. At the beginning of year, that number was 3%.ii Now it's 2.9%.iii So right now, inflation expectations don't look worried about tariff price shock, and they don't seem worried about the debt stock or the deficit.

Source: Federal Reserve Bank of New York, Haver Analytics, as of 26 August 2025.

Source: Federal Reserve Bank of New York, Haver Analytics, as of 26 August 2025.

The chart presented above is shown for illustrative purposes only.

Matt: I find that the forward-looking inflation can be explained a lot by people's historical experience of inflation. In other words, is it a really good predictor of future inflation? Because during the 1970s, the bond market was terrible at pricing inflation. If you looked at bond investing during that period of rising inflation, returns from bonds adjusted for inflation were lower than promised, right? That is because the market fell short of correctly pricing the rise in inflation. And on the way down, they overpriced inflation. Now, could it be that we're on the other side of this? When we look at what the bond market is pricing in now, the question is whether it’s correctly pricing in long-term inflation being higher. I don't really think so.

Hassan: In addition to what Dave's raised on the inflation expectations front, I would raise the geopolitical front—there's been a structural weaponization of the dollar now for successive US administrations from both parties. And you're starting to see central banks respond to this. They were net sellers of gold; they're now net buyers. Countries that are big gold producers are increasingly buying their own gold and shipping less. Gold as a percentage of reserve composition is going up. We've seen break points in other currencies. Sterling used to be $4.86, and more recently it approached parity with the dollar.

Q: Is there anything you feel optimistic about in this reshuffled world order?

Matt: It's all about carry. You don't have to take a lot of risk. You don't have to go way out on the curve to get yield and can keep your duration relatively short.

Hassan: I like to think of two Gs—growth and governance. The breakup of free trade into multiple zones creates a less efficient world, in my view. Corporates may see lower margins and a higher cost of capital. Certain areas of emerging markets may begin to stand out because Chinese growth is lower and western growth has some structural problems. There can be a lot of biases and fixations on a country’s recent past that may not represent a country’s future potential. When I look at some of the ratings agencies, governance seems to be a huge component of their ratings. I see a big opportunity set for active managers in emerging markets that are willing to form a differentiated view of governance.

David: I think this is a good time to be a bond manager. I’m not too concerned about the risk of a major world war. I see room for growth in many regions. Given how much investors have over-owned the US in the last 10 years, I think non-US investors will be rethinking the markets they want to invest in. I expect large flows out of the US, which means that I'm a multi-year US dollar bear, and I'm bullish everywhere else.

Session Two - What Does “Flight to Quality” Mean in 2025?

Introduction

In terms of traditional economic theories, the first half of 2025 may have been an aberration or the beginning of a general shift in market reaction mechanisms. We sat down with Elisabeth Colleran, CFA, Emerging Markets Portfolio Manager, Mike Gladchun, Associate Portfolio Manager, and Sean Walton, CFA, Senior Fixed Income Trader, for their views.

Q: Has the flight-to-quality playbook changed?

Sean Walton: I’d say the playbook is evolving. Looking at the first half of 2025, Treasury yields and equity performance did not provide the expected negative correlations. "Liberation Day" on 2 April, prompted an inflationary supply shock risk-off event, with equities weaker in the initial days following the announcements. And counter to some investors’ expectations, long Treasurys underperformed. However, risk asset performance bounced back quickly and demonstrated unanticipated resilience.

Mike Gladchun: In my mind, you need to differentiate risk events between those derived from lack of demand versus those induced by supply shocks. The source of the risk event defines how a flight-to-quality event progresses. Treasurys tend to provide value to investors in more organic economic slowdowns that progress along the contours of the business cycle. If we have a business cycle slowdown where demand starts to wane, slack builds in the economy, disinflationary pressures grow and margin pressure weighs on corporate earnings, then Treasurys can provide benefits. However, Treasurys aren’t likely to perform that safe-haven role in the event of inflationary supply shocks, which are really what we’ve been contending with the most in recent years. I would also point out that we haven't had a really sustained risk-off event in quite a while. Such events have been fleeting.

Elisabeth Colleran: I agree. Capital market events have been fleeting, and I don’t see that changing. The volatility this year simply is not coming from the emerging markets (EM). Even where we have had risk-off events like the Israel/Iran conflict in June or the India/Pakistan crisis in May, asset price reaction was mostly short-lived and contained with little contagion across broad EM. Rather, global market dynamics are shifting based on the massive uncertainty emanating from US trade and fiscal policies and the country’s role in global security.

Sean: Investors are questioning the US’ credibility and source of stability; the traditional risk-free asset is the one adding capital market risk. Assets aren't going to move in quite the same historical way, in my view.

Mike: From my point of view, the lack of durability of these events lessens the need to hedge or respond. When policy pronouncements are the source of the risk, circumstances could be changed by something as simple as a social media post. So, has the playbook changed? I think the game's a little bit different in this period of policy volatility and uncertainty. But, if and when we get into a cyclical slowdown that follows the typical contours of the business cycle, I think the old playbook is likely to serve investors well.

Elisabeth: I think one of the primary strategies should be taking a global view. Since you don’t know from one hour to the next how US developments will influence capital markets, why not expand the investment opportunity set and hedge your bets broadly? Diversification could be the new flight to quality.

The global buyer has a lot of options, in my view. Look at the EM asset class—it has evolved. Many EM countries offer economic stability. In the wake of the COVID-19 pandemic, we saw countries in Latin America and central Europe come out and hammer inflation; they didn’t wait for developed market central banks to make the first move. Instead, these EM central banks and policymakers took matters into their own hands, demonstrated skill and built up their credibility. This has helped EM market stability so that today, we rarely see broad risk-off reactions that reverberate through the EM market. I think the global opportunity set for an investor considering defensive positioning has expanded. And I’ll add that foreign exchange rates, interest rate differentials and trading patterns are sweetening the EM value proposition, in my view.

Source: Bloomberg, as of 22 August 2025. The Sharpe ratio is a measure of excess return per unit of risk. A higher ratio implies a higher investment return compared to the amount of risk of the investment.

The chart presented above is shown for illustrative purposes only. Some or all of the information shown may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles.

Sean: In a similar vein, I see shifting reaction functions in Europe. The US Vice President’s speech at the Munich Security Conference in February left European countries questioning their geopolitical relationships and defense structures with regard to the US. This has had implications for asset allocations. I think we are seeing this play out in FX—hedge first and then deal with your underlying assets. With regard to trade, developed markets have also pursued new or expanded relationships. Canada has reached out to the European Union (EU) and Japan to discuss their own agreements. I would argue that trade developments have helped the EU in a march toward further integration. Some of these steps are also driven by security concerns, such as Germany's decision to increase military and infrastructure spending. I think that could help the EU move toward perhaps some enhanced form of common issuance. Not soon, but it’s the incremental steps being taken that I think further evolves the playing field over time. If the EU starts to issue debt to finance infrastructure, it will create another pool of investment grade assets. Again, not tomorrow, but it's building. And I think that could further change the game going forward.

Q: Do you think more fiscal spending globally will change the way investors approach the long end of the yield curve?

Sean: We’re seeing some of that already—the widespread need for increased issuance is hitting the back ends of different government yield curves around the globe. There's a lot of fiscal spending on the table in Japan, and we’ve seen a lot of ink spilled on the topic of the back of the Japanese government bond yield curve. The back end of the UK Gilt curve has been a bit of a mess too. And now that Germany is expected to increase issuance to fund fiscal spending, the back end of Germany’s curve has had some upward pressure as well. Japan has a big pension industry, and so do the UK and Europe. But a lot of pension funds aren't buying super long-end bonds anymore because as the population has aged, their liabilities have shortened in duration to the neighborhood of 15 to 20 years. Buying a 40-year bond isn't what they need at a time when people are looking to spend more. It’s an area where the game may have changed just a little bit. In my view, it's a supply dynamic, at least outside the US, that could potentially become something of a problem that needs watching. I’m not saying any of these bond markets lead the Treasury market, but the Treasury market doesn’t trade in isolation either.

Source: Bloomberg, as of 26 August 2025.

Source: Bloomberg, as of 26 August 2025.

The chart presented above is shown for illustrative purposes only. Some or all of the information shown may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles.

Mike: The game does seem to have changed a bit from a global perspective. But for the US Treasury curve, I don’t think things have drastically changed in that regard. The long end has always been the point on the curve that is least sensitive to cyclical factors, at least in the first order. So, I think the back end of the curve is generally more of a value call for investors rather than a cyclical call. With a steep curve and elevated term premium, there are potential opportunities to add value trading the long end of the curve. And if we get to the point where we're seeing heavy disinflation and potential deflation, then the back end of the curve could really deliver, in my view. It’s the place I’d want to be if there's a break-the-glass event. But, in a more likely run-of-the-mill business cycle slowdown, I’d rather be in the belly of the curve, which I think will continue to perform its traditional role as a flight-to-quality instrument.

Session Three - Where’s the Growth?

Introduction

An uncertain growth landscape does not mean a lack of growth potential. Pramila Agrawal, PhD, CFA, Portfolio Manager, Director of Custom Income Strategies, Tom Fahey, Co-Director of Macro Strategies, and Peter Yanulis, Alpha Strategies Portfolio Manager and Strategist, see plenty of areas of potential short- and long-term opportunity.

Q: We’ve seen our fair share of uncertainty and major policy decisions in 2025. Do you see any relative country or industry beneficiaries in this landscape?

Pramila Agrawal: The trade war is so broad-based that it's hard to look around and identify any clear beneficiaries in the short term. This is disrupting over 60 years of trade harmonization, optimizing supply chains and aligning manufacturing for maximal global growth. In the short term, it seems to me that everybody faces downside risks from this.

Tom Fahey: Yes, the trade war is rearranging supply chains that have been built up over decades and throws long-standing relationships and the global trading environment into question. One upside for the US is the tariff revenue, but there is a lot of near-term downside risk with all the disruption. If it was profitable to manufacture and export from the US, the American entrepreneur would find a way to do so.

Source: Haver Analytics, as of 22 August 2025.

Source: Haver Analytics, as of 22 August 2025.

The chart presented above is shown for illustrative purposes only.

Pramila: Ultimately, tariffs will manifest as a tax that corporations will either bear or pass on to their suppliers or consumers. Will they absorb the cost, letting it eat into margins to prevent price increases? Or will they pass the costs to the consumer, which will translate to goods inflation?

Peter Yanulis: Near term, I think we’ll see a mix of both—pressure on corporate margins and elevated consumer prices. Over the longer term, policy reactions and eventual realignment may unlock growth opportunities by promoting domestic investment and closer regional ties.

Pramila: It does seem like some beneficiaries could emerge long term. One potential prospect is Europe, but that is highly contingent on synchronized monetary and fiscal policies across countries and getting on the same page in terms of dealing with China and the US. Europe has been underinvested for decades in key areas like defense and technology. It does, however, have fiscal headroom and the US tariff regime is catalyzing Europe into more spending in these areas. In addition, they have had a spate of populist governments come into power that are committed to making these investments.

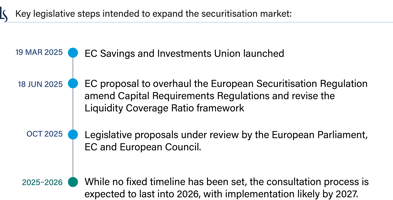

Tom: I agree that a renewed focus on defense and domestic-oriented spending in Europe is a big positive. Europe is also keen to make their capital markets deeper and more coordinated to attract capital flows from investors that may be discouraged by US policies.

Pramila: We could also see good developments in some of the Eastern Bloc nations, which have rallied around China since the 2018 US tariffs were announced. I think a lot of people would agree that deglobalization would be a disservice to all countries. However, we could see re-globalization. Instead of the world being one large, unified trading bloc, it could break up into smaller trading blocs. For example, Canada, Mexico and Latam countries might align in a trading bloc centered around the US. Or countries like Vietnam, Malaysia, Indonesia, India and Russia might realign their supply chains in a trading bloc oriented around China. Europe, which trades with Eastern and Western countries, could be a third trading bloc with Germany at its epicenter. I think the countries that can position themselves well within their respective trading blocs will do well over the long term.

Q: Do you think now is a good time to diversify away from the US?

Pramila: I’m not giving up on the US, but diversifying could provide pockets of spread opportunity. Some might say EM could be negatively impacted by tariffs, but I think many EM countries have already shown resilience given supportive monetary and fiscal policies and a stable local buyer base.

Tom: I agree. Global interest rates have risen dramatically. The US dollar has been expensive, but year to date it has declined rapidly. I’m looking forward to non-US dollar opportunities, especially in Latin America and Eastern Europe.

Peter: I think cyclical and structural factors are transitioning the US dollar into a multi-year bear market. In our view, moderating US exceptionalism, tariffs, rich US-dollar-denominated valuations, fiscal deficit expansion and monetary policy uncertainty are contributing to a reallocation of capital from the US to rest-of-world assets, including EM debt. Additionally, non-US investors have been increasing their domestic-currency hedge ratios as foreign exchange volatility impacts risk-adjusted returns on US holdings. I believe the weaker US dollar will be a major tailwind for EM debt as stronger currencies boost local-currency bond returns while making it cheaper for issuers to service dollar-denominated debt. As Pramila pointed out, EM economies have improved their fiscal positions and matured their bond markets. I expect stronger fundamentals and lower risk of default in several large EM countries. Importantly, EM debt offers a moderate correlation to developed market bonds and equities, which helps provide a diversification benefit to global investors in this weak dollar regime. I think this is particularly valuable in times of volatility. Recent data shows record inflows to EM local bonds year to date after more than a decade of underinvestment, and I expect this trend to continue.iv

Pramila: I’ll add that because the bear run in the US dollar may be a long and volatile one, I think it’s important for investors with exposure to local currencies to think about their hedging strategies. In my view, investors seeking diversification should consider diversifying across non-US assets as long as it aligns with their liabilities and risk objectives.

Q: Let's talk about layering in your day job. How are you putting fixed income assets to work in this environment?

Pramila: Despite all the conversations about volatility, uncertainty and dislocations, I think fixed income is in a position of strength. The macro environment doesn’t have us fleeing for the hills in terms of taking down risk or duration or fearing a big default cycle waiting around the corner. I think that the US economy is in late cycle. There can be some turbulence, but generally we are anchored by a strong consumer and robust corporate health. Real rates are high after being negative for a very long time.

Tom: We are back to levels that we used to view as normal (i.e., a federal funds rate at 4.5% and a positive yield curve). Yes, we had a bout of inflation, but even Europe and Japan exited the zero-interest-rate policy.

Pramila: And with real rates where they are, all-in yields across different fixed income sectors look very healthy. For a fixed income investor, I see very little downside because the carry cushion is insulating investors from modest spread widening. At current levels, spreads would have to widen a lot for us to see negative total returns. Expected total returns for most fixed income asset classes look healthy, in the single digits to mid-single digits, with some even in the high-single digits.

Source: Bloomberg, as of 26 August 2025.

Source: Bloomberg, as of 26 August 2025.

The chart presented above is shown for illustrative purposes only.

Peter: I agree that high real rates are providing a nice cushion for fixed income investors. Looking ahead, I think the Fed will cut rates, but I expect shallow cuts rather than a rapid easing cycle, which would help maintain healthy yields in fixed income.

Pramila: If the cutting cycle is half of the typical 200-300 basis points, that would keep rates high relative to history while still benefiting from the cuts. I would view that as the best of both worlds. So where is my team buying right now? For duration, we think the belly of the curve (five to seven years) is generally a good place to be, as it’s more insulated from reinvestment risk than the short end, and less subject to volatility from the long end. For our benchmark-aware portfolios, we are staying close to benchmarks. In terms of our beta or portfolio risk, we are in the middle of the range between no risk to full risk-on.

Peter: My team also favors the belly of the yield curve (5 to 10 years) as we think ultra-long bonds carry too much interest rate risk amid continued expansionary US fiscal policy. We recently shifted our corporate debt allocation to favor fixed-rate debt over floating-rate debt (e.g., global high yield credit over loans) in anticipation of more Fed easing. Within fixed-rate debt, we see the most attractive relative value in EM, particularly frontier hard-currency and local-currency sovereign bonds.

Pramila: With spreads as tight as they are, we’ve been thinking about where to reach to get the best risk-adjusted yield. The commercial ABS sector has been our favorite lately, and we have captured some additional spread and yield in agency MBS. We also like private credit because it allows us to access pockets of investments not readily available through the public market, like opportunities in infrastructure, sports and student housing. In corporate bonds, we don’t think there’s enough compensation for going down the quality ladder to single Bs or triple Cs because the spreads have really compressed. When spreads are this tight, downside risks outweigh upside risks, so I think it’s important to become very specific about security selection.

Endnotes

i On April 2, 2025, President Trump announced a broad package of tariffs and declared the day “Liberation Day.”

ii Median five-year expected inflation rate; Federal Reserve Bank of New York, January 2025.

iii Median five-year expected inflation rate; Federal Reserve Bank of New York, July 2025.

iv https://money.usnews.com/investing/news/articles/2025-06-17/analysis-emerging-market-local-currency-debt-could-end-decade-long-drought-as-dollar-wanes

Disclosure

Published 4 September 2025.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Markets are extremely fluid and change frequently.

Diversification does not ensure a profit or guarantee against a loss.

Past market experience is no guarantee of future results.

8337790.1.1

Current Positioning

We had already extended duration in anticipation of more onerous tariffs prior to the Liberation Day announcement (2 April). Persistent market dislocations have led us to add modestly to our duration stance while also taking advantage of the sharp credit widening in investment grade and high yield, adding some selective exposure in issues that have re-priced wider. This has been done both in the primary and secondary markets.

We also took advantage of the relatively strong agency MBS performance to shave exposure and build more liquidity in US Treasurys. Despite the retaliatory tariff pause, the ongoing escalation with China and the already in-place tariffs with other trading partners has made us more cautious over US growth prospects in 2025. This is reflected in our lower base case and bear case growth estimates and revised credit spread targets.

Currently, our nominal duration is about 0.5 year long, while our empirical duration is shorter at just +0.25 years. In terms of key rate duration, we still have our largest overweight to the belly (five-10 years), but are now slightly overweight the 30-year as well, to capitalize on what has been a significant dislocation in longer-dated Treasurys as leverage comes out of our rates markets.

Our overall Government sector allocation remains highly liquid and defensive, with about 2/3s of the portfolio in USTs and Agency MBS.

Opportunities/Risks We’re Watching

While further bear steepening is possible, we believe our long-end exposure may prove to be an important hedge against greater deterioration in the US economy in conjunction with a Fed that chooses to remain sidelined due to nearer-term tariff inflation pressures.

We are currently assessing worst-case scenarios for growth and inflation and the likelihood of both market and policy responses to such scenarios, as we digest new announcements of retaliation and/or efforts to negotiate by other countries.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

We are slowly starting to pick away at potential credit opportunities Many more bids for risk than offers so far, which is typical in these very volatile environments. There is an element of price discovery taking place today.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.