KEY TAKEAWAYS

A 2016 IBM report1 estimated 90% of the world's data at that time was created in the prior two years. Further, it is likely that only 20% of the world’s data is structured. Data scientists are using machine learning and AI to monetize this dizzying pace of data creation in a broad array of sectors, including autos, consumer electronics, healthcare and air travel.

Within the finance sector, companies are reaching beyond the established role of AI in high-frequency trading systems that manipulate thousands of securities and millions of data entries. Quantitative managers are creating investment strategies that harness AI in an attempt to enhance investment performance.

For instance, the implementation of Natural Language Processing (a subset of AI) allows one, in hours or even less, to go through all crude-oil-related news in the Wall Street Journal since 1960. With this information, an analyst could score the frequency of certain sentiment-oriented words, which he or she could use as an indicator of market sentiment. Most importantly, AI could analyze this historical news and established facts without bias, which is impossible for a human.

What are the implications of this relatively new component of investment decision making for investors? The following points should help guide investors as they consider portfolios that incorporate AI-based decision making.

Weekend chefs can rely on online recipes to create meals. However, they can only try to understand how the ingredients will work together to create an entrée’s characteristics. They are not food scientists. A similar pattern exists on open platforms for quantitative finance.

With the availability of online tools and open-source platforms, offering quantitative finance education, data and tools, users—weekend quants—have created a plethora of algorithms for investment strategies. However, do these same users understand how the signals generated from a mix of raw data can influence portfolio performance?

Financial markets are not stationary. Myriad factors influence data on any given trading day. As a result, algorithms designed to interpret and act on ever-changing data need to be insightful and adaptable. To develop such processes requires skill and time. It can take years of development and testing to gain confidence in an AI-driven strategy, primarily because quantitative analysts have to spend enough time understanding the algorithm, the markets and the economic forces behind why strategies work and don’t work. Not all algorithms are suitable for all kinds of problems.

When considering an investment strategy that incorporates AI decision making, meet the person who created the algorithm. What is his or her background and years of experience? Which leads to the next consideration….

2. QUALITY OF ALGORITHM TESTING

Quantitative analysts use backtests to judge the efficacy of a trading signal. It can be quite easy to fine-tune parameters of the readily available algorithms to show splendid backtests. However, this is over-fitting. It can give false hope that such techniques would result in good live performance. It is essential to question practitioners about the backtesting framework applied and the metrics used for testing sensitivity to parameters. It is also important to know the procedure adopted to avoid look-ahead bias. For example, some portfolio managers have strong views about timing and diversification, which essentially stems from a look-ahead bias. Working with quantitative analysts, they often introduce these as explicit rules in their systematic investing framework (to obtain results that match their intuition).

Most algorithms fail because the quantitative analyst was careless, not because the algorithm made mistakes by making undirected changes. Backtesting integrity is critical and when done correctly will allow practitioners and non-practitioners alike to trust AI systems.

3. CUSTOMIZED ALGORITHMS

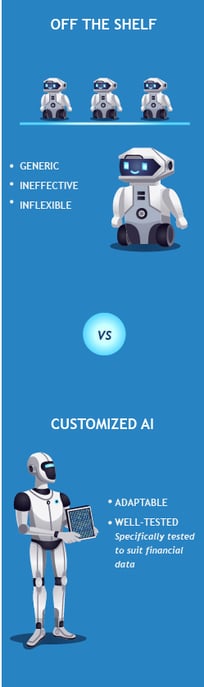

Investments based on trivial modifications of existing standard algorithms can lead to the proliferation of ineffectual systems. In the past, a significant proportion of the standardized algorithms were initially designed and calibrated to reduce human effort and processing time. It would be surprising if such algorithms could be adapted for successful trading strategies.

Most people in the world might be prosperous traders if standardized algorithms could be used for building successful trading strategies. We are not suggesting that off-the-shelf algorithms are not useful. Investors could use them for research as well as constructing some derived signals. However, on balance, it has usually been a combination of standardized and modified algorithms that have produced strong investment alphas.

Artificial intelligence, together with increasingly capable computing power and developed theories, can function as a powerful rule-based engine that helps enable one to tackle many once-seemingly-impossible tasks.

According to a recent poll conducted by BarclayHedge, 56% of hedge fund respondents in the alternative investment sector use AI or machine learning in their investment process.2

Whatever techniques are used, there will always be questions about whether AI can really succeed on Wall Street. Even if a few investment strategies achieve success with AI, the risk is that others will duplicate the strategy and thus undercut its success. This will most certainly arbitrage some opportunities away.

That is why we believe it is important to look for strategies that are dynamic; not limited to just evolutionary algorithms,3 but embrace a wide range of technologies. It is also important to stay ahead of the curve. The whole idea is to find a strategy (or manager) that is doing something no other human nor machine is doing. An AI strategy is most likely to succeed when built with a unique perspective that is different from others.

|

DEFINING AI MIT defines AI as a system or a machine that can reason, learn, act intelligently and perform tasks normally achieved by humans. This is an academic definition. Meanwhile, computer scientist and corporate AI innovator Lawrence Tesler’s definition suggests that “AI is whatever has not been done yet,” and that the “AI effect” occurs when onlookers discount the behavior of an AI program by arguing that it is not real intelligence.4 Notably, the definition of AI consistently evolves with our understanding of it. Consumers reconsider AI as routine technology as products relying on it become integrated into their lives. For example, a Roomba has now evolved into a regular vacuum cleaner. As the technology and understanding of AI improves, tasks that have been solved using AI are often removed from the definition of AI. Just like the mystery of magic fades once the trick behind it is revealed, the “intelligence” of any AI system is arguable once the logic behind its output becomes comprehensible and widely accepted. |

1IBM Marketing Cloud whitepaper, “10 Key Marketing Trends For 2017,” published December 2016.

2Majority of Hedge Fund Pros Use AI/Machine Learning in Investment Strategies, BarclaysHedge, 7/17/2018.

3Evolutionary algorithms are computer applications that mimic biological processes in order to solve complex problems. Over time, the successful members evolve to present the optimized solution to the problem.

4AZQuotes.com

Diversification does not ensure a profit or guarantee against a loss.

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product. Any investment that has the possibility for profits also has the possibility of losses.

Past market experience is not a guarantee of, and not necessarily indicative of, future results..

This paper is provided for informational purposes only and should not be construed as investment advice. Opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted, and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice.

This document may contain references to third party copyrights and trademarks, each of which is the property of its respective owner. Such owner is not affiliated with Loomis, Sayles & Co, L.P. (“Loomis”) and does not sponsor, endorse or participate in the provision of any Loomis funds or other financial products.

LS Loomis | Sayles is a trademark of Loomis, Sayles & Company, L.P. registered in the US Patent and Trademark Office.

MALR024774

Loomis, Sayles & Company, L.P. | One Financial Center, Boston, MA 02111 | 800.343.2029

Sitemap | Privacy Policy | Cookie Policy | Important Information