Global Emerging Markets Equities Team

Why Loomis Sayles for Global Emerging Markets Equities?

A Private Equity Approach to Public Equities

High-quality companies are rare, particularly in emerging markets. Our goal is to invest in, and hold over the long-term, strong companies in industries that are experiencing secular growth.

We conduct deep, independent and iterative fundamental research of companies within their ecosystems in order to identify those few names that we believe are truly high quality, or on the path to becoming high quality. We seek to unlock additional value by only investing in these names when they trade at a significant discount to their intrinsic value.

A Distinct Alpha Engine

Our approach, and our results, are different.

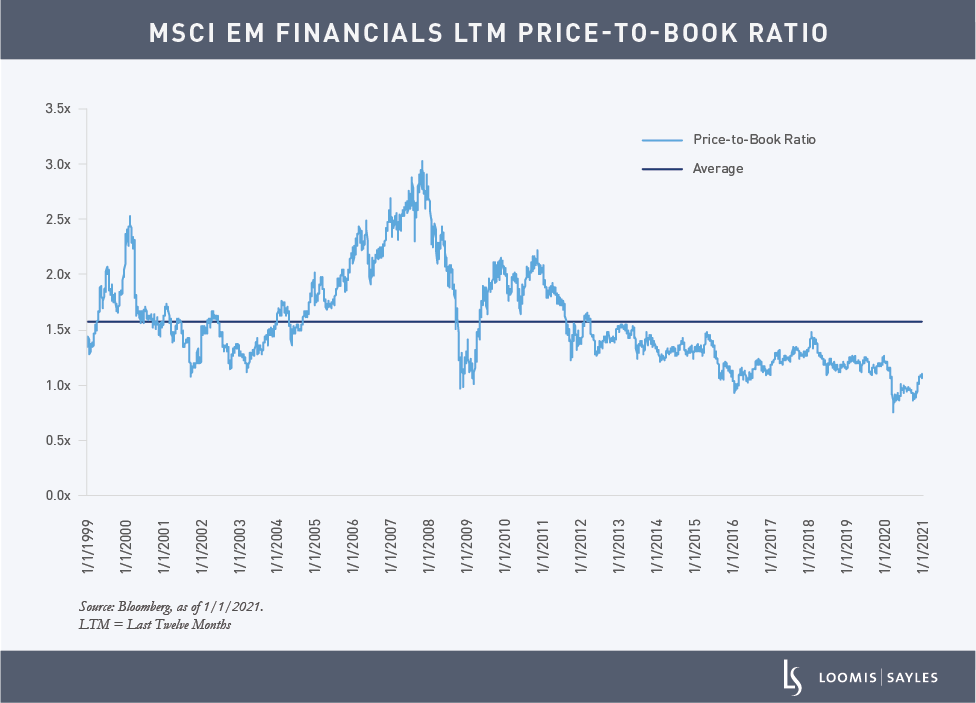

We believe analyzing emerging markets through a financial lens differentiates our research process. By conducting an extensive analysis of banks and other financial institutions in the markets in which invest, we extract insights on the financial underpinnings of sectors and companies that the market might be missing.

Connecting the dots through our “ecosystem research” allows us to build a robust mosaic of the company we are researching. We benefit from the ability to leverage our firm wide deep, fundamental EM credit and sovereign research teams.

Differentiated & Experienced Investment Team

70 years of combined investment experience across private and public equities.

Deep roots in hedge fund investing fuels our rigorous research up and down capital structures.

Our team is structured by sector - not country - allowing for industry expertise, grounded in shared regional knowledge, which empowers informed team discussions and debate.

Our Philosophy

Investors may have a tendency to think about emerging markets as a single asset class. Contrary to this persistent bias, we believe compelling emerging market opportunities can be identified by active investors who understand the unique drivers within each emerging market. As a benchmark-agnostic investment team, we don’t think in terms of “over-weight” or “under-weight.” Instead, our goal is to generate alpha and absolute return through bottom-up stock-picking in high quality or transitioning-quality companies based on our private equity approach to research and deep knowledge of the diverse markets in which we invest.

At a Glance

-

We think like “owners” and take a long-term, private equity approach to investing in stocks

-

We believe bottom-up, fundamental research & due diligence are key in identifying truly high-quality, and transitioning to high-quality, businesses within emerging markets

-

We manage concentrated, high conviction portfolios

-

We are benchmark agnostic

Meet the Team

Collegial Culture. Methodical Approach.

Ashish Chugh

Portfolio Manager

Ashish Chugh

Portfolio Manager

Juhee Han, CFA, FRM

Senior Research Analyst

Juhee Han, CFA, FRM

Senior Research Analyst

Eric Spencer, CFA

Senior Research Analyst

Eric Spencer, CFA

Senior Research Analyst

Our Strategy

Global Emerging Markets Equity

Strategy Inception 10/7/2019

Highlights

The Global Emerging Markets Equity strategy seeks to provide long-term growth of capital

-

Primary Benchmark: MSCI EM Gross Total Return Index

Team Insights

Emerging Markets' Balancing Act: Pursuing Growth Amid Higher Rates

Higher interest rates may pressure growth in some emerging markets, but Senior Research Analyst Eric Spencer highlights areas where he believes higher rates could benefit corporate profitability.

Is it Time to Pick Up Chinese Equities?

Senior Research Analyst Ji Zhang shares why he believes negative sentiment could present potential opportunities in selected Chinese stocks with long runways for growth.

Börsen-Zeitung

“India is already a very big economic power”

Emerging markets expert Ashish Chugh sees bright prospects for India - China remains a difficult place for investors - Brazil surprised under Lula.

EM Equities Outlook: Opportunity Amid Structural Shifts and New Dynamics

Portfolio Manager Ashish Chugh shares his outlook on themes and dynamics influencing the emerging market equities sector in 2024.

Positive Surprises in Brazil Underline Structural Improvements

In Brazil, Senior Analyst Ji Zhang sees potential opportunity in resilient businesses against a backdrop of falling inflation and possible central bank easing.

Three Questions on Political Risk in Emerging Markets

With several EM countries facing elections in the next 12 months, Eric Spencer, Senior Research Analyst on our Global Emerging Market Equities team, weighs in on potential risks and opportunities.

2022 EM Equity Outlook: Views on Fed Hikes, China and Russian Tensions

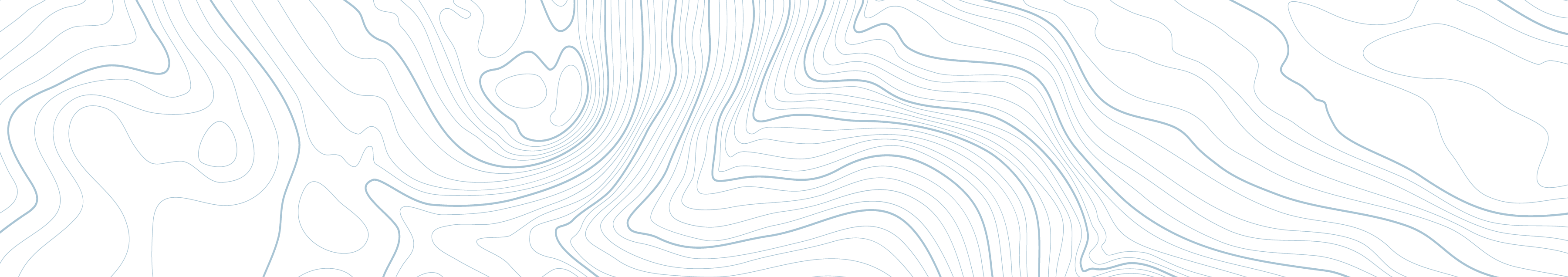

In our view, some investors have a misperception that higher US rates are bad for EM equities.

Rethinking Current Macro-Driven Fears About EM Equities

Investor fears about inflation and higher rates contributed to periods of selloff in emerging market (EM) equities during the second quarter.

The New Drivers Behind EM Equity’s Remarkable Rebound

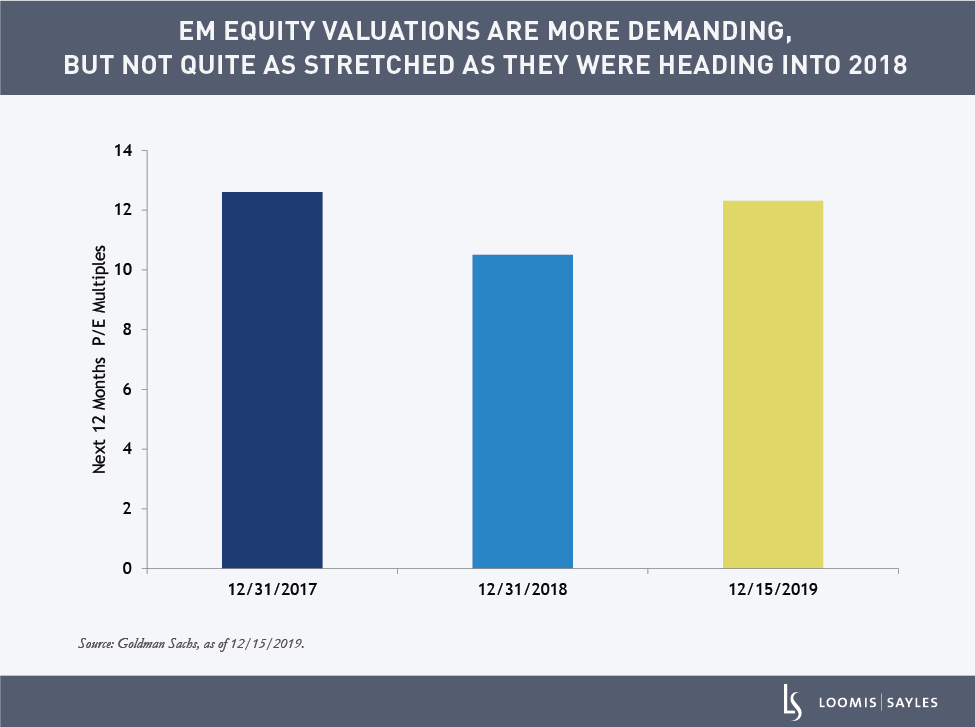

Like most risk assets, emerging market (EM) equities were hit hard by the pandemic, but they’ve made a remarkable rebound.

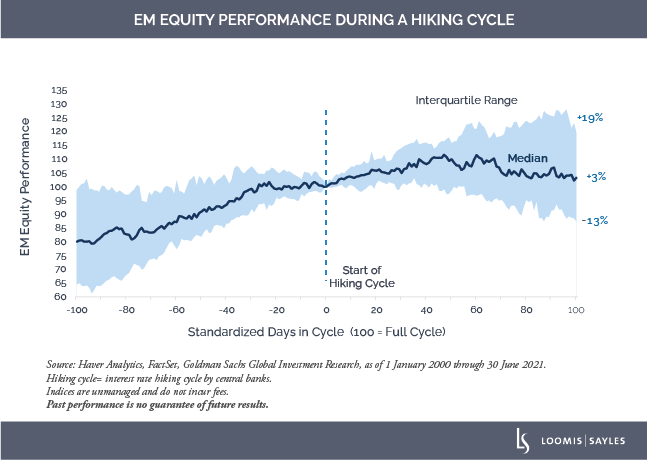

2021 Outlook: Three Questions on Emerging Market Equities

If growth in EM economies rebounds as we anticipate, inflation could play the spoilsport. However, we believe economic recovery could help supply chains normalize and aggressive developed market monetary expansion could help EM currencies appreciate, which should contain inflation pressure.

Emerging Market Equities: Three Questions on What's Changed Since the March Madness

Portfolio Manager Ashish Chugh answers three questions about emerging market equities and what's changed since the market tumult in March.

Bright Spots Among the Risks: Emerging Market Equities

COVID-19 and turbulence in the oil market have been reshaping daily life, economic fundamentals and market activity for weeks. Emerging markets, like the rest of the world, have been along for the ride.

2020 Sector Outlook: Emerging Market Equities

COVID-19 and turbulence in the oil market have been reshaping daily life, economic fundamentals and market activity for weeks. Emerging markets, like the rest of the world, have been along for the ride.

Turkey's Back in the Headlines: What This Could Mean for Turkish Banks

With the latest crisis in Turkey, Turkish equities have come under pressure and Turkish bank stocks are looking cheap. Do they really offer value?

Let's Connect.

Jennifer DiMario

Director, Strategic Marketing

Disclosure

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Investment decisions should consider the individual circumstances of the particular investor. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Information, including that obtained from outside sources, is believed to be correct, but we cannot guarantee its accuracy. This information is subject to change at any time without notice.

Key Risks: Equity Risk, Market Risk, Non-US Securities Risk, Liquidity Risk.

Investing involves risk including possible loss of principal.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Commodities, interest, and derivative trading involve substantial risk of loss.

Market conditions are extremely fluid and change frequently.

Diversification does not ensure a profit or guarantee against a loss.

Any investment that has the possibility for profits also has the possibility of losses.

There is no guarantee that the investment objective will be realized or that the strategy will generate positive or excess return.

Past performance is no guarantee of future results.

MALR031892