Extra Credit

Understanding Loomis Sayles’ Risk Premium Framework: A Forward-Looking Common Language

Key Takeaways

-

The Full Discretion team utilizes our proprietary credit risk premium framework, which is calculated as spreads less estimated losses from downgrade and defaults.

-

Loomis Sayles’ Applied IQ team created a tool called the Credit Health Index, or CHIN, that provides a forward-looking view of US corporate health through a combination of macro, financial market and policy variables. The CHIN is a key input into the Full Discretion team’s top-down risk framework.

-

The risk premium framework can be applied to all credit markets, but for strategies that can invest in less liquid or private markets, there are additional factors that are assessed.

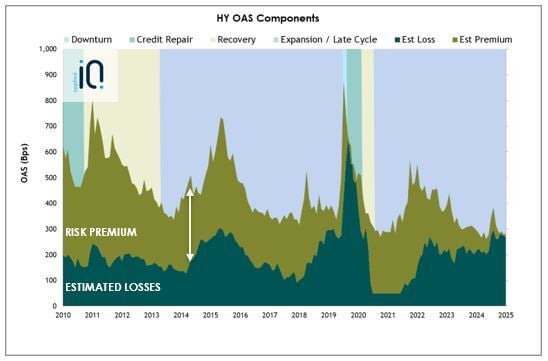

When it comes to assessing value across various fixed income credit markets, we believe the big picture is essential. For the Full Discretion team, the big picture means analyzing where we are in the credit cycle and calculating the current risk premium, defined as a market’s option-adjusted spread (OAS) less our estimated one-year-forward losses from downgrades and defaults.

We believe risk premiums can help determine the likelihood of positive excess returns more effectively than spreads alone. We often observe credit cycle stages where spreads are tight relative to history, and it’s less clear how much risk should be taken. On the other hand, when spreads are wide, many think it’s a good time to pile into higher yielding securities because they don’t consider the potential for escalating losses. Instead of only taking a narrow view of spreads, our risk premium framework focuses on expectations for losses due to default and downgrade. Risk premium is simply the gap between spreads and estimated losses.

The risk premium only moves because of a change to spreads or our estimated loss expectations, which typically results in less volatility. Downgrades and defaults are often cyclical and tend to be less turbulent than spreads, providing potential opportunities for the Full Discretion team to better identify relative value in credit markets. The combination of where we are in the credit cycle and how much risk premium is available provides three unique insights.

Risk premium:

- gives us an unemotional measure of value in the market

- guides how much risk our products should be taking

- helps us compare opportunities as we allocate across asset classes as well as the public and private options within each

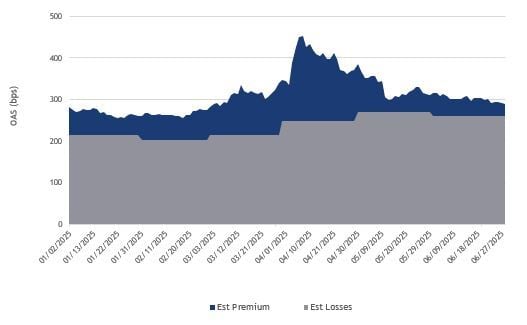

Estimated High Yield Risk Premium Components Over Time

Source: Loomis Sayles, Bloomberg and Moody’s, as of 9/30/2025. OAS is based on the Bloomberg US Corporate High Yield Index.

The chart presented is shown for illustrative purposes only. Some, or all, of the information on these charts may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles.

This analysis is based on historical data and does not predict future results. Therefore, the use of this type of information to make investment decisions has inherent limitations. Markets may behave very differently than history suggests, it is not possible for any methodology to accurately identify and interpret all relevant market events.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Please see the Risk Premium Disclosure Statement for additional important information.

Past performance is no guarantee of future results.

The CHIN: Our Differentiated View on Estimating Losses from Downgrade and Default

To better understand the potential for credit losses from downgrades and defaults, our Applied IQ team created a proprietary tool called the Credit Health Index, or CHIN. The CHIN is a macroeconomic research tool that analyzes financial market and policy variables to give us a forward-looking view of US corporate health and a common language for discussing it. The CHIN framework then translates the corporate health view into a forecast of losses from downgrades and defaults.

For example, when a mid-cycle slowdown occurs sending markets into a tailspin, it helps us identify when prices have moved away from the fundamentals. When the CHIN is high, it indicates low potential for losses and vice versa. We can then compare the CHIN's output with spread levels to help us gauge whether we are being compensated for the risk we are taking. The result is a predictive framework that connects the Full Discretion team’s portfolio managers and strategists to the firm’s research analysts, traders and macro strategists to debate opportunities.

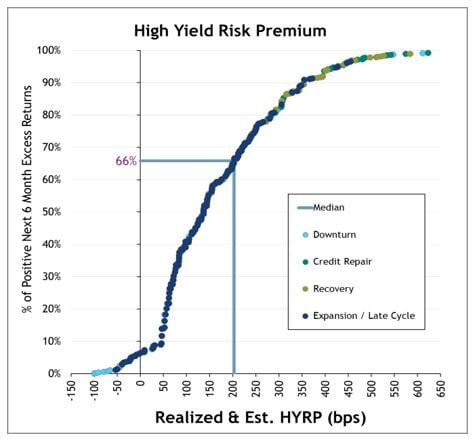

Median High Yield Risk Premium & Probability of Positive Excess Return

Source: Loomis Sayles, Bloomberg and Moody’s, as of 9/30/2025. OAS is based on the Bloomberg US Corporate High Yield Index.

The chart presented is shown for illustrative purposes only. Some, or all, of the information on these charts may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles.

This analysis is based on historical data and does not predict future results. Therefore, the use of this type of information to make investment decisions has inherent limitations. Markets may behave very differently than history suggests, it is not possible for any methodology to accurately identify and interpret all relevant market events.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Please see the Risk Premium Disclosure Statement for additional important information.

Past performance is no guarantee of future results.

Looking at current values against long-term averages also informs our understanding of whether today’s markets are cheap or rich, and then we can adjust our positioning. According to our research, as risk premiums climb, the probability of positive excess returns over the next six months also increases. We’ve found that this generally means that investors are rewarded for leaning into risk throughout the various phases of the credit cycle. However, there are times when risk premiums are on the tighter end of historical averages. We then need to allocate our risk budget accordingly, seeking opportunities in other markets or leaning into our security selection disciplines. We believe that the risk premium framework is a differentiated feature of the Full Discretion team’s investment process.

An Example of Risk Premium in Action: A Mid-Cycle Slowdown in April 2025

Source: Loomis Sayles, Bloomberg and Moody’s, as of 6/30/2025

We started 2025 in the late cycle/expansion phase, the portion of the credit cycle where the market tends to spend of the most time. As the credit markets priced in optimism toward favorable business outcomes due to anticipated Trump administration policies, risk premiums in the high yield market ground tighter. Things changed quickly over the next few months with sweeping tariffs introduced in early April. Spreads widened by over 100 basis points (bps) in a matter of days, but given the underlying strength of corporate fundamentals, we didn’t perceive an equal increase to our estimate for losses.

During this period, the risk premium approached the median for a late cycle environment, which signaled a potential buying opportunity in the high yield market. Over the course of ten days, we added a significant amount in high yield exposure across Full Discretion accounts.

In our view, the opportunity was short-lived. By the end of the month spreads had tightened again, and market data showed more signs of weakness that could indicate higher losses ahead. The risk premium framework gave the team the conviction to act quickly during challenging days.

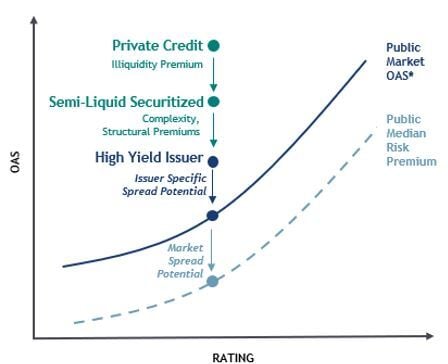

Public vs. Private Risk Premium

The Role of the Risk Premium in Public and Private Markets

When looking across our opportunity set, we tend to start with the high yield market as a base for assessing risk premium. This requires identifying and valuing key considerations to determine whether we are being adequately compensated for the risks taken. In doing so, we also focus on idiosyncratic dimensions of credit risk that may impact an issuer's performance, such as profitability and loan-to-value ratios. This investment framework provides a foundation for evaluating opportunities across the quality and liquidity spectrum, where transparency can be more limited and pricing dynamics can be less efficient, in our view.

For strategies that can invest in less liquid or private markets, there are additional factors that we’ll assess. We believe that these investments should offer additional opportunities for illiquidity, complexity and structural risks that are less common in public markets. Allocations will be made to less liquid or more complex securities when we believe we are adequately compensated for these considerations.

For decades, the Full Discretion team has invested through numerous credit cycles with both calm and turbulent markets. Our goal is to invest by measuring our risk/return through a consistent and repeatable process. The risk premium framework helps us deliver on that by leveraging a multitude of inputs to create a common understanding of credit market risk.

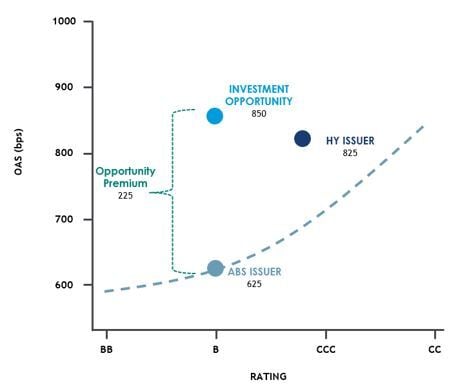

Making the Trade: How We Value Complex Ideas

Internet access is a both crucial and growing part of life for consumers and businesses. A national provider of fiber-based data services, and a historically large issuer in the high yield market, issued a first-time debt transaction for a fiber network securitization. The issuer offered multiple tranches with spreads ranging 350-850bps. Our deal team underwriting the investment was comprised of research analysts with diverse expertise, which helped us decompose the issue-specific traits to identify relative value.

Public vs. Private Risk Premium

We evaluated the B-rated asset-backed security that was offered at 850bps using our unified research and portfolio construction process:

- At the time of syndication, B-rated asset-backed securitizations (ABS) typically traded with a spread of around 150-250bps tighter than unsecured high yield bonds of the same issuer because they often have stronger collateral security, asset backing and bankruptcy remoteness. However, that was not the case in this instance as it was offered at 850bps, which caught our attention.

- There were known risks associated with an inaugural offering and a novel approach to securitization using a retail fiber network. Given the complexity of the structure and the semi-liquid nature of the securitization, we believed that we should be offered additional spread of at least 200bps.

- Comparable unsecured high yield bonds available in the market at the time had a spread of 825bps.

- We believed that the securitization was attractive because it offered an additional 25bps of spread relative to other unsecured high yield bonds and adequately compensated for the complexity and illiquidity. Additionally, the securitization featured improved downside protection due to its collateral package and capital structure seniority.

Important Disclosure

CREDIT CYCLE REGIME PERIODS

EXPANSION/LATE CYCLE:

4/1/1997- 8/31/2000; 3/1/2006-12/31/2007; 1/1/2014- 2/28/2020; 4/1/2021 - 9/30/2025 (PRESENT)

DOWNTURN:

9/1/2000 - 11/30/2001; 1/1/2008 - 6/30/2009; 3/1/2020 - 4/30/2020

CREDIT REPAIR:

12/1/2001 - 5/30/2003; 7/1/2009 - 5/31/2011; 5/1/2020-10/31/2020

RECOVERY:

6/1/2003 - 2/28/2006; 6/1/2011-12/31/2013; 11/1/2020 - 3/31/2021

As of 9/30/2025

Regime periods are determined by Loomis Sayles Macro Strategies team based on a variety of subjective and objective factors, including past economic and asset performance metrics. Views and opinions expressed reflect the current opinions of the team, and are subject to change at any time without notice. Other industry analysts and investment personnel may have different views and opinions.

RISK PREMIUM DISCLOSURE

This material is provided for informational purposes only and it should not be construed as an investment advice. Investment decisions should consider the individual circumstances of the particular investor. Any opinions or forecasts contained herein reflect subjective judgments and assumptions of the author and do not necessarily reflect the views of Loomis, Sayles & Company, L. P. Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted. Proposed solutions and related analysis does not represent the actual or expected future performance of any Loomis products. We do not intend to imply that we managed actual portfolios with these characteristics during the periods shown or that we could construct actual portfolios with these characteristics and return experience. Accuracy of data is not guaranteed but represents our best judgment and can be derived from a variety of sources. Opinions are subject to change at any time without notice.

While the analysis provided may be shared with one or more investment team, it is not the only input into the investment process for any strategy and therefore should not be viewed as a primary source of investment decisions, which are a function of many variables.

The analysis is based on historical data and does not predict future results. Markets may behave very differently than history suggests, it is not possible for any methodology to accurately identify and interpret all relevant market events. Therefore, the use of this type of information to make investment decisions has inherent limitations. There is no guarantee that future experience will be similar. The analysis reflected in this presentation is limited to certain periods. We make no representation that the experience of any other periods is comparable.

Unless otherwise specified, all analysis covers the period from 6/30/1996 to 9/30/2025

ADDITIONAL IMPORTANT DISCLOSURE

Principal Investment Risks: Investments in bonds can lose their value. When interest rates rise, bond prices usually fall and vice versa. High yield securities are subject to a high degree of market and credit risk, including risk of default. In addition, the secondary market for these securities may lack liquidity which, in turn, may adversely affect the value of these securities and that of the portfolio. Foreign investments involve special risks including greater economic, political and currency fluctuation risks, which may be even greater in emerging markets. Currency exchange rates between the US dollar and foreign currencies may cause the value of the investments to decline. Commodity-related investments, including derivatives, may be affected by a number of factors including commodity prices, world events, import controls and economic conditions and therefore may involve substantial risk of loss. Equity securities are volatile and can decline significantly in response to broad market and economic conditions.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the Full Discretion team only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There can be no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. Accuracy of data is not guaranteed but represents our best judgment and can be derived from a variety of sources. Opinions are subject to change at any time without notice.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

This is not an offer of, or a solicitation of an offer for, any investment strategy or product.

Market conditions are extremely fluid and change frequently.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Past market experience is no guarantee of future results.

For Institutional Use Only. Not For Further Distribution

8525412.1.1

Meet the Managers

The Full Discretion team is made up of 27 professionals with 23+ years average of investment experience globally.

Meet the Managers

Matt Eagan, CFA

Head of Full Discretion, Portfolio Manager

Brian Kennedy

Portfolio Manager

Peter Sheehan

Portfolio Manager, Credit Strategist

Michael Klawitter, CFA

Portfolio Manager, Bank Loans Strategist

Heather Young, CFA

Portfolio Manager, Bank Loans Strategist

Eric Williams

Portfolio Manager

Bryan Hazelton, CFA

Portfolio Manager, Associate Portfolio Manager, Investment Grade Strategist

Chris Romanelli, CFA

Portfolio Manager, Associate Portfolio Manager, High Yield Corporate Strategist

Chris Romanelli, CFA

Portfolio Manager, Associate Portfolio Manager, High Yield Corporate Strategist

Scott Darci, CFA

Portfolio Manager, Associate Portfolio Manager, Convertibles & Equity Strategist

David Zielinski, CFA

Investment Director

Cheryl Stober

Investment Director

Kristen Doyle

Associate Investment Director

The Full Discretion Approach to Credit Selection

During our decades as bond investors, we’ve managed through all sorts of credit conditions. And we have consistently observed that the market is inefficient at pricing-specific risk.

We use repeatable credit selection strategies to capitalize on this persistent inefficiency and drive excess return potential.