Investment Outlook

As inflation continues to trend lower, most central banks appear to be done hiking interest rates.

The European Central Bank (ECB) and Bank of England (BoE) seem content to hold policy rates near current levels, even with real growth near 0%. The Federal Reserve (Fed) has indicated rate cuts will likely be its next move. We believe 25 basis point cuts are likely in June, September and December 2024. Our view is less aggressive than what fed funds futures pricing suggests.

The interest rate outlook is a critical driver of our economic and investment views. Globally, monetary policies have been restrictive and growth rates have moved lower. We believe the United States can avoid recession, at least for the next few quarters, but continental Europe may not.

Key Takeaways

Our take on macro drivers and major asset classes at a glance.

Macro Drivers

Inflation should continue to drive monetary policy decisions, but we are also keenly focused on corporate profits returning to growth, particularly in the US.

Corporate Credit

As we enter 2024, spreads on US and European corporate credit are tight, particularly in this late stage of the credit cycle.

Government Debt & Policy

We think government bond yields have most likely peaked for this cycle.

Currencies

In our view, emerging market (EM) currencies could start to outperform the US dollar more broadly as a soft landing plays out in the United States.

Equities

Typical of early forecasts, consensus 2024 earnings growth estimates for the S&P 500 Index were very robust in early December.

Potential Risks

We have grown more optimistic about the economy. Risk assets largely reflect expected economic progress and valuations across most markets have risen.

Our core belief is that corporate profits drive the credit cycle. A downturn is less likely now that the US earnings recession is over.

- At the start of 2024, domestic inflation is slowing broadly and the Fed appears willing to pivot toward fed funds rate cuts by mid-2024.

- If the fed funds rate remains stable while inflation is coming down, then monetary policy is technically becoming more restrictive – something the Fed wants to avoid this late in the cycle with economic growth below trend.

- While somewhat rare historically, we believe that a soft landing is occurring in the US, with US real economic growth positive, unemployment relatively stable and core inflation moving toward 2.5% by mid-2024.

- We believe this can be achieved so long as year-over-year corporate profit growth comes through in the mid-single-digit range, which is actually lower than current Bloomberg consensus.

- In our opinion, companies are likely to retain workers so long as profits are on the rise, making widespread layoffs unlikely.

The Earnings Recession Was Not Deep Enough to Drive the Credit Cycle Into Downturn

We believe earnings should grow 6.0% in 2024, below Bloomberg consensus

of 11.0%.

Source: Bloomberg, as of 18 December 2023.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past market experience is no guarantee of future results.

With spread compression less likely, we believe that investors should be able to harvest a potential yield advantage that corporate bonds offer relative to Treasurys.

- Current valuations, in terms of spread in excess of US Treasury yields, may not look attractive, but we think yields on corporate credit do look compelling.

- We are not anticipating a default wave. Therefore, a nearly 8.0% yield on US high yield credit could be an opportunity for equity-like returns. Investors less willing to move lower in credit quality could turn to investment grade corporates yielding about 5.0%.1

- The proprietary quantitative and fundamental frameworks we utilize, such as our Credit Health Index (CHIN), recently turned higher and have been signaling the US economy is firmly in late cycle expansion—not downturn.

- The same quantitative-based framework estimates an annual high yield default rate of just 2.2%. While expected defaults have been low relative to history, we find that the estimate has been consistently rising.

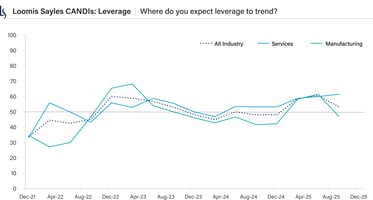

- Bottom-up, industry-specific fundamental analysis from our deep bench of senior credit analysts filters into our process through our proprietary Credit Analyst Diffusion Indices (CANDIs). This survey-based framework recently suggested that key fundamentals, such as profit margins and pricing power, are improving—albeit from the weak levels of the 2023 earnings recession.

- We welcome these indicators of corporate health improvement and believe much of this positive expectation has already been priced into credit markets.

The CHIN Represents a Weighted Basket of Indicators That Have Statistically High Correlation to Movements in the Credit Cycle

We are noticing positive change in corporate health across a number of our frameworks.

Source: Loomis Sayles, monthly data shown from of 1 December 1977 to 18 December 2023.

Charts are illustrative for presentation purposes only as a sampling of risk management tool output. Some or all of this information on these charts may be dated, and, therefore, should not be used as a basis to purchase or sell any securities. The information is not intended to represent any actual portfolio managed by Loomis Sayles. Views and opinions expressed reflect the current opinions of the QRRA team, and views are subject to change at any time without notice. Other industry analysts and investment personnel may have different views and opinions. Markets may behave very differently than history suggests, it is not possible for any methodology to accurately identify and interpret all relevant market events.

See Endnotes for Credit Cycle Regime Periods and CHIN definition.

Central banks around the world have their own timelines, but we believe rate hiking cycles are broadly in the rearview.

- Inflation rates are well off their highs in developed and emerging economies now that supply chain issues have normalized.

- As an ongoing critical policy driver, we believe inflation will likely dictate just how much central banks can reduce rates.

- We think developed market longer-term yields could slide lower in 2024. We are constructive on US duration and expect the 10-year yield to find fair value around 3.5% by fall 2024.

- We do not think the US Treasury’s anticipated large debt issuance will meaningfully influence the direction of interest rates.

- We think market focus will likely gravitate toward potential US presidential election outcomes in the second quarter as potential policy shifts become a bit clearer.

- We believe in the Fed’s independence and do not think politics will enter its calculus with respect to interest rate policy. The Fed’s dual mandate will continue to be its most important objective regardless.

Inflation Should Continue to Cool as Economic Growth Slows

We believe inflation will continue to decline in 2024, allowing central banks to cut rates.

Source: LSEG Datastream, data as of 18 December 2023.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

We anticipate easier financial conditions in the US, especially when the Fed starts to ease interest rates. Typically, such an environment fosters US dollar weakness.

- The ECB and the BoE may hold policy rates steady, while the Fed begins to cut the fed funds rate. The resulting short-term rate differentials could lead to euro and pound sterling strength in early 2024.

- We believe that developed market currencies could outperform the US dollar in early 2024, but perhaps not for the entire year. At some point in the second half of 2024, the ECB and BoE are likely to cut policy rates too, recognizing that inflation has come down and economic growth is slowing.

- Our outlook on EM currencies has shifted. We think a weaker US dollar regime could bolster EM currency returns, particularly those with relatively higher interest rates than that of the US.

- Most foreign currencies should outperform the US dollar given our view that the current phase of the credit cycle is not coming to an end. The downturn phase is likely next, but we do not expect it to occur over the next six months—perhaps not even in 2024.

- EM local-currency bonds have the potential for carry above that of high-grade US fixed income as well as favorable currency performance. We think local currency 10-year bonds in Brazil, South Africa and Mexico could be attractive.

- We think US dollar indices should continue to trade with a weak tone now that the Fed hiking cycle appears to be over.

The US Dollar Could Continue to Trade Lower, Especially if the ECB and BoE Hold Steady While the Fed Cuts

After being very selective in 2023, we are considering EM currencies more broadly.

Source: Bloomberg, Federal Reserve, data as of 18 December 2023.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past market experience is no guarantee of future results.

We believe that a strong recovery in EM earnings could occur after the weak stretch of the past several quarters of 2023.

- There is a very high probability that second-quarter 2023 results marked the trough in S&P 500 Index year-over-year earnings per share (EPS). Overall, we expect S&P EPS growth to be flat for 2023.

- A stable-to-lower interest rate environment and less upward wage pressure should help corporate bottom lines, in our view. The Loomis Sayles equity sector team currently forecasts 2024 EPS growth of 6.0%.

- Trailing 12-month profit margins showed improvement with a definitive move higher. But with slowing economic growth and less inflation, we believe the average top-line growth will likely be harder to generate. We do not see an obvious catalyst to drive meaningful profit margin expansion, but in our opinion, stabilization is fine.

- Going into December, the Russell 1000 Growth Index reported a wide margin of year-to-date outperformance relative to the Russell 2000 Index and the S&P Small Cap 600 Index. However, market breadth has been improving recently and we believe that this may continue in early 2024.

- From a sector perspective within the S&P 500 Index, mega-cap technology companies and technology-like businesses accounted for the significant outperformance. Communication services and consumer discretionary sectors have also performed well, which offers a positive forward-looking signal with respect to the credit cycle. For equity market performance to broaden, we think small-cap companies, and those in less-defensive sectors, will need to advance.

Bottom-Up Consensus Earnings Estimates Suggest 11% Growth in 2024, Which We Find Too Optimistic

We expect GDP growth to be below trend and earnings to grow in the mid-single-digits range.

Sources: I/B/E/S – The Institutional Broker’s Estimate System, as of 18 December 2023.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Past performance is no guarantee of future results.

We have grown more optimistic about the economy. Risk assets largely reflect expected economic progress and valuations across most markets have risen.

- Our core view is that the global economy is slowly weakening as a result of fierce monetary tightening. We suspect the downturn phase of the credit cycle is further out on the horizon. That said, we are wary of discounting potential downturn signals, such as curve inversions and significant declines in leading economic indicators.

- Traditional recession signals are flashing and have been for several months. There is the possibility that a downturn and broader recession could occur in 2024.

- In such a case there would be meaningful corrections across credit and equity markets which have already largely discounted a soft landing scenario.

- We believe the probability of a soft landing is quite high, and therefore see markets as fairly priced—offering carry in credit markets but not much potential for spread compression.

- Our big-picture view includes lower global interest rates, which could favor long-duration positioning relative to benchmarks. In such a scenario, the risks would be higher and stickier inflation, which would likely keep central bank policies tighter for longer.

- A profit growth recovery is also key to the soft landing. If the recovery to date proves to be a blip, then there is the potential for layoffs, which could hit consumption and potentially drive an economic contraction.

Asset Class Outlook

We are constructive on duration and neutral on credit. We would look to add growth equity exposure on weakness.

Author

Craig Burelle

Global Macro Strategist, Credit

Credit Cycle Regime Periods

Disclosure

The Credit Health Index (CHIN) is a macro tool created by Loomis Sayles. The CHIN is currently managed by the Loomis Sayles QRRA team. It is proprietary framework that utilizes a combination of macro, financial market and policy variables to project US corporate health. A higher reading indicates stronger corporate health whereas a lower reading indicates weaker corporate health.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis do not represent the actual or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Past performance is no guarantee of future results.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Diversification does not ensure a profit or guarantee against a loss.

Market conditions are extremely fluid and change frequently.

Commodity, interest and derivative trading involves substantial risk of loss.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

LS Loomis | Sayles is a trademark of Loomis, Sayles & Company, L.P. registered in the US Patent and Trademark Office.

MALR032352