Investment Outlook

Oftentimes, tighter monetary policy exposes financial excesses and pockets of risk within an economy.

In the current late-cycle environment, this may be the case. Stricter lending standards and stress within the financial sector are not welcomed events. However, with regard to inflation, tighter overall financial conditions should limit credit availability and, in turn, limit consumer and business borrowing and spending.

Central banks appear willing to use the lending channel and a hit to economic growth to bring inflation back to target levels. Does that mean an economic recession is on the horizon in the United States? We estimate that there is at least a 50% chance of recession within the next six months.

Key Takeaways

Our take on macro drivers and major asset classes at a glance.

Macro Drivers

Economies and markets grow vulnerable to shocks when monetary and fiscal policy are less accommodative.

Corporate Credit

Over the next year, we anticipate substantial interest coverage and limited maturities should help keep the default outlook muted relative to past late-cycle environments.

Government Debt & Policy

Inflation will likely reemerge as a key focus for global central banks in the next quarter.

Currencies

We believe short-term rate differentials should ultimately drive the direction of dollar indices. However, we anticipate a strong bid for US dollars if markets turn risk averse.

Equities

Macro headwinds and weakening fundamentals may present a challenging setup for equity benchmarks.

Potential Risks

A cautious asset allocation stance with a tilt toward fixed income is warranted in our view given macroeconomic headwinds and a corporate profits recession appearing to take hold.

Since the banking sector developments in March, financial sector stress and the potential for additional bank failures have drawn investor focus. But in our view, investors should not forget about inflation risk.

- The rate of corporate profit growth has been under pressure globally since the initial rebound that kicked off this credit cycle. Some slowing was anticipated, but widespread contraction now seems more likely.

- US large-capitalization corporate profits contracted year over year in the fourth quarter of 2022.[1] We expect another contraction in the first quarter of 2023, which would be considered a “technical” profits recession.

- When corporate profitability begins to falter, the fundamental backdrop for credit can deteriorate quickly, especially when leverage is rising.

- We expect a US corporate profits recession to spark layoff announcements as companies look to lower costs.

- The unemployment rate is typically the last indicator to signal weakness before recession hits.

- Spiking unemployment and contracting profits could catalyze a US recession this year, particularly with the financial system already under strain.

- We believe the Fed may pause rate hikes, but will be slow to pivot toward rate cuts while core PCE inflation is well above target.

Leading Economic Indicators Have Fallen Rapidly

The Conference Board’s index of 10 leading economic indicators is approaching levels consistent with recession.

Source: The Conference Board, February 2023 reading published 17 March 2023.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Credit spreads across several corporate benchmarks have widened to reflect increased risk of a downturn, but have yet to reach their 2023 high point.

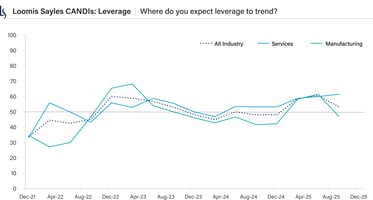

- Our Credit Analyst Diffusion Indices (CANDIs), an internal survey framework used to poll Loomis Sayles’ credit research analysts, indicates some leveling off in the fundamental outlook after signaling deterioration for the past few quarters.

- However, when our analysts look toward the next six months, key corporate health fundamentals including pricing power and profitability remain at weak levels for most industries.

- The weakening operating backdrop assessed by our bottom-up credit research team is consistent with our macro strategies team’s top-down view that the US economy is entrenched in late cycle currently and could enter a downturn within six months.

- We see margin pressure in non-commodity and consumer-related sectors including autos, retail, consumer products, railroads, metals and mining and restaurants. We expect supply chain issues and wage pressures to ease moderately but to persist through the first half of 2023.

- At the end of March, our risk premium framework still suggested high yield and investment grade credit could potentially generate positive excess returns in 2023.

Benchmark Credit Spreads Reflect Some Economic Weakness Ahead But Do Not Appear Anywhere Near Recessionary Levels

Looking to industries we believe most able to withstand the coming economic slowdown.

Source: Bloomberg and JP Morgan as of 29 March 2023.

The chart presented above is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. The information is not intended to represent any actual portfolio currently managed by Loomis Sayles. Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Past performance is no guarantee of future results.

Swift action by US and European governments may have prevented a more protracted financial panic.

- The Fed may pause or even conclude its tightening phase of this cycle in May, but in our view that does not signal rate cuts are right around the corner.

- Market pricing seems optimistic that Fed rate cuts are on the 2023 horizon, but we believe the economy would have to be in a downturn for those cuts to be realized.

- We agree that much of the stress within the US financial system would only be exacerbated by additional rate hikes. However, the Fed is still fighting a battle against inflation, which is running at twice its target rate.

- The Fed is far from alone. Core inflation in the euro zone and UK is likely to remain an even more significant issue for the European Central Bank (ECB) and Bank of England (BoE) compared to the Fed’s challenges.

- The long end of developed market yield curves could remain range-bound as market participants assess financial sector and recession risks. Expectations for higher policy rates, which drove longer-term rates higher in 2022, have slowly reversed course.

Core Inflation Measures Are Showing Very Little Sign of Backing Off

Attention could pivot back to excessive inflation if banking concerns ease.

Source: National Sources, February 2023 core inflation readings.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

The US dollar typically performs well when there are macroeconomic risks bubbling over abroad.

- There is potential for the ECB and BoE to continue hiking policy rates if the Fed takes a pause because inflation has been an even bigger concern for those economies. Secondly, the ECB and BoE are not as far along in their tightening cycles as the Fed.

- The US dollar has weakened modestly in recent weeks on that theme, which is likely to continue into the second quarter. However, if a downturn begins to take hold in the US late next quarter, we believe investors will flock to the dollar seeking a “safe haven” as other markets likely turn away from risk.

- We believe emerging market local-currency bonds are a place to potentially earn carry over high-grade US fixed income issues and present potential for strong currency performance. We think select markets could do well, even if the US dollar rallies.

- Preferred local-currency markets include Mexico, where the central bank was quick to hike policy rates this cycle. South Africa is another favored market where there could be structural improvements over the long term.

- In Asia, we currently prefer Indonesia local-currency bonds and believe its central bank has finished hiking rates. The Japanese yen also has room to strengthen should investors seek relative safety in volatile global markets.

We Expect US Dollar Indices to Regain Their Footing Later This Year

The US dollar’s relative “safe haven” status could be beneficial if economic growth dips and other markets turn risk averse.

Source: Bloomberg, Federal Reserve, data as of 29 March 2023.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

We believe tighter financial conditions, less pricing power and declining margins should lead S&P 500 consensus earnings estimates around 10% lower from the current $220 level.[2]

- Our corporate health frameworks suggest companies are currently in decent shape, but directionally, fundamentals are trending lower, which could limit potential total return upside given rich valuations.

- We believe security selection will be critical in this late-cycle environment. Growth equity overall looks set to continue outperforming the market backed by companies with strong fundamentals relative to broader large-cap indices.

- Profitability is considered one of the most important fundamental drivers of total return over time. The technology sector remains a relative leader with respect to return on equity and profit margins.

- Certain segments of value equity, including industrials, have seen earnings estimates for calendar year 2023 climb in recent weeks. We anticipate potential outperformance in sectors and styles where fundamentals are improving, or at least showing relative strength.

- Stark underperformance of financials has become a global phenomenon. However, we anticipate long-term challenges within the sector based on stiff competition and less pricing power.

- It is difficult to see how equity valuations could expand in late cycle. We expect range-bound equity benchmarks and focus to be on leading styles, factors and securities.

S&P 500 Operating Profit Margins Track Nominal GDP Closely

Our house view for slower nominal GDP growth is likely to usher in lower profit margins.

Source: Bloomberg, Loomis Sayles US economic forecast as of 31 March 2023.

Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the Macro Strategies team only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

This material is for informational purposes only and should not be construed as investment advice. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This material cannot be copied, reproduced or redistributed without authorization.

A cautious asset allocation stance with a tilt toward fixed income is warranted in our view given macroeconomic headwinds and a corporate profits recession appearing to take hold.

- Our core view is that the global economy is in a vulnerable position and therefore at risk of entering the downturn phase of the credit cycle. Most asset valuations are not presently reflecting levels traditionally seen in a downturn.

- A profits recession is anticipated by some market participants, but not to the degree that we would expect. If US large-cap earnings contract by 10% in 2023, it could cause a downward repricing of asset valuations.

- Governments swooped in to fence off financial sector woes, but there could be more to the issue than meets the eye. We are watching for further systemic risk within the banking sector, particularly in commercial real estate.

- Ultimately the depth of a downturn will be determined in our view by Fed policy, specifically its reaction to incoming inflation data. If core inflation remains well ahead of target, as it is now, we would not expect the Fed to immediately cut policy rates.

- The US economy has absorbed a number of hits, including the housing sector’s decline, spiking auto prices, surging interest rates and levels of inflation not seen since the 1980s. With a corporate profits recession likely, we will be watching for signs that the rock-solid labor market is finally beginning to crack.

Asset Class Outlook

We are constructive on duration and fixed income overall. Potentially attractive opportunities to enter global equities are likely to present themselves if fundamentals near a bottom.

Author

Craig Burelle

Global Macro Strategist, Credit

Disclosure

This commentary is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis do not represent the actual or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Past performance is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Diversification does not ensure a profit or guarantee against a loss.

Commodity, interest and derivative trading involves substantial risk of loss.

LS Loomis | Sayles is a trademark of Loomis, Sayles & Company, L.P. registered in the US Patent and Trademark Office.

MALR030760