Actions & Reactions: Rethinking the Global State of Play

We are closely monitoring developments in US and global trade policy, and their impact on global financial markets. This includes actively monitoring and assessing attractive opportunities and potential risks on behalf of our clients. Read on for key insights from our investors as they navigate this period of uncertainty.

VIEWS FROM THE MACRO STRATEGIES TEAM

● Updated 12 June 2025

What’s Next for the Credit Cycle?

- Trying to forecast the economy with flip-flopping tariffs and trade policy is like building a house on shifting sands—it’s hard to feel confident without a solid foundation. We expect significant uncertainty to persist. Attention has turned to the tax and reconciliation bill moving through the US Congress.

- It may take time for the impact of tariffs to show up in economic data. First-quarter reported earnings were generally strong, but trade disruption is weighing on the outlook for credit. Profits and consumption are key indicators to watch, in our view.

- We believe the US economy can avoid a downturn in the near term, but we expect slower growth and higher inflation. We expect elevated volatility to continue.

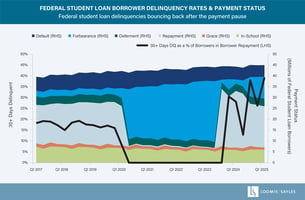

Graphic Source: Loomis Sayles. Views as of 12 June 2025. The graphic presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

-

15-17 June 2025

G-7 summit in Alberta; President Trump will attend.

-

16-20 June 2025

US House of Representatives in recess.

-

17-18 June 2025

The Federal Reserve’s Federal Open Market Committee (FOMC) meets; it will release an updated Survey of Economic Projections.

We think a rate cut is highly unlikely.

-

24-25 June 2025

NATO summit in The Hague.

President Trump plans to attend.

-

30 June - 4 July 2025

US House of Representatives and Senate in recess.

The Senate hopes to work out a final budget and send it to the House for a final vote before the recess. We believe that is possible, but a long shot.

-

End of June 2025

US Supreme Court term concludes; Court in recess until October.

-

3 July 2025

US Employment Report.

-

8 July 2025

The president's pause on reciprocal tariffs, authorized with the IEEPA, (International Emergency Economic Powers Act), expires.

-

15 July 2025

Consumer Price Index (CPI) Report.

-

24 July 2025

US House of Representatives leaves for August recess.

This is the deadline for the House to pass a final budget.

-

29-30 July 2025

The Fed’s FOMC meets.

-

31 July 2025

The US Court of Appeals for the Federal Circuit will hear oral arguments regarding the US Court of International Trade’s ruling regarding the use of IEEPA.[1]. (The appeals court allowed the IEEPA tariffs to remain in place during the appeals process.)

[1] The US Court of International Trade ruled that the president cannot use emergency declarations to impose tariffs under the IEEPA.

-

1 August 2025

Senate leaves for August recess, employment report released.

This is the deadline for the Senate to pass a final budget. The House and Senate could change the dates of the recess if necessary.

-

Mid-August 2025

Estimated date when the debt ceiling will become binding, known as the "X-date."

The proposed budget increases the debt ceiling. If Congress fails to pass a budget by this time, it must increase the debt ceiling with regular legislation, which would need bipartisan support. If the debt ceiling isn't increased by the X-date, the federal government goes into technical default.

-

16-17 September 2025

The Fed's FOMC meets; it will release the updated Survey of Economic Projections.

-

30 September 2025

The US federal government’s fiscal year 2025 concludes.

Congress must pass a budget or a continuing resolution by this date, or a partial federal shutdown would start 1 October.

-

31 December 2025

All tax cuts from the Tax Cuts and Jobs Act of 2017 will expire at midnight unless Congress changes the law in the budget.

-

1 February 2026

The vacancy on the Federal Reserve Board of Governors vacated by Adriana Kugler must be filled by this date.

Given the lengthy nomination process, the person who will replace Kugler will likely be nominated by late-Summer. Of course, Trump could take his time and leave the post open, but he has every reason to fill it fast. Whoever gets the nomination for the vacancy will be perceived as the shadow Fed Chair.

VIEWS FROM THE MACRO STRATEGIES TEAM

● Updated 4 June 2025

Major Variables We’re Watching

TARIFFS

What we know: The US Court for International Trade (CIT) has rejected emergency tariffs authorized through the International Emergency Economic Powers Act (IEEPA). The Trump administration has appealed the decision. All tariffs imposed during President Trump’s first term and sectoral tariffs remain. Trade talks are ongoing. The 90-day pause on IEEPA-authorized country-specific reciprocal tariffs ends on 9 July; the reprieve on US-China tariffs ends 14 August.

What we don’t know: Just how high the final effective tariff rate will be. Will the US Supreme Court uphold the CIT’s ruling? Will tariffs encourage a realignment of global trade? How will tariffs impact US real GDP? Will companies be able to absorb the added cost of tariffs, or will the cost be passed on to consumers?

Our view: The pieces of the tariff puzzle keep shifting. Regardless of the outcome, the world faces a major and disruptive step up in tariff rates. Tariffs are a tax on growth, but are unlikely to drive the US economy into recession on their own unless they are raised much higher than we currently expect. In any case, we think it likely that tariff hikes will be passed onto the consumer, eventually spiking inflation.

THE BUDGET AND DEBT CEILING

What we know: The House of Representatives passed a budget in the tightest vote possible (Republicans delivered 215 yes votes; Democrats and two dissident Republicans delivered 214 no votes.) The so-called "One Big Beautiful Bill" (OBBB) must now make it through the Senate for review. While some changes are likely, the bottom line on deficits is unlikely to change much.

As it stands, the OBBB is estimated to raise the debt ceiling (a.k.a., the debt limit) by $4 trillion. The debt ceiling is predicted to become binding sometime in August, at which time the federal government will not be able to cover its obligations. Congress must pass a budget by the end of July to avoid a Treasury default. If it cannot pass a budget by that time, it will need to raise the debt ceiling using stand-alone legislation, which would require bipartisan cooperation.

The OBBB did nothing about tariffs except eliminate the de minimis exemption for duty-free imports for all countries. It is worth noting that when the Congressional Budget Office (CBO) “scores” the budget, resulting deficit projections will exclude any revenues from new tariffs, which will not be a small amount of revenue. When the CBO scores a budget, it only uses what is in the budget.

A forecast of spending and revenue that includes everything, including tariffs, could be more optimistic than the CBO projects. On the other hand, the economy could be weaker than the baseline assumptions used by the CBO, resulting in a boost to the deficit.

What we don’t know: Will the budget be passed by 31 July? Will it result in fiscal austerity or stimulus? What will tariffs look like? How will both developments shape the budget deficit? How will Treasury yields behave? How will the Federal Reserve react?

Our view: The budget has yet to be finalized. If it results in fiscal austerity—spending cuts and higher taxes—it would be a drag on GDP. On the other hand, a fiscal impulse, or stimulus of lower taxes and bigger deficits could reduce recession odds and the potential for Fed easing while potentially boosting inflation risk.

THE FED AND MONETARY POLICY

What we know: The next Federal Open Market Committee meeting is scheduled for 17-18 June. After its May meeting, the FOMC noted the increasing uncertainty about the economic outlook and rising risks of higher unemployment and higher inflation. It stated that it is attentive to both sides of its dual mandate. The FOMC will have another employment report and CPI report to weigh in its next decision.

What we don’t know: How much will tariffs impact inflation? For how long? Will stricter immigration policies affect employment? A large drop in net immigration could slow the growth of the working-age population, which would slow the pace of sustainable payroll growth. Will trade uncertainty inhibit hiring? Will deregulation and tax cuts boost hiring?

Our view: We think the Federal Reserve is in a bit of a bind. On the one hand, the labor market remains firm, and weekly initial jobless claims have been low. On the other hand, consumers expect higher inflation as tariffs work their way through the economy. The Fed seems to be taking a “wait and see” approach for now.

Once the boost from tariffs passes, we expect inflation to resume its downward trend. So far, the labor market slowdown has been driven by lower job openings rather than falling payrolls or layoffs. We may see the unemployment rate rise further as firms ease up on hiring, but mass layoffs seem unlikely unless corporate profits take a big hit. We think the Fed would respond to a clear rise in the unemployment rate with further rate cuts. Until then, the Fed is likely to stay on hold.

CORPORATE HEALTH

What we know: Large-cap margins in the US are currently near record levels and earnings have held up well. Our proprietary Credit Health Index, or CHIN, is at a healthy level consistent with an expansion. However, our Credit Analyst Diffusion Indices, or CANDIs, signaled a weakening outlook among our credit analysts.

What we don’t know: How will uncertainty impact capital expenditures and investment? Will companies be able to pass on higher costs to consumers? Will companies experience a supply shock from trade barriers? How much will margins decline if the economy weakens? Will deregulation and tax cut extensions provide a boost?

Our view: Corporate health appears solid. Bottom-up credit fundamentals and margins are in good shape. That said, we anticipate a more challenging operating environment for corporates in the coming months, especially smaller businesses, as they navigate uncertain trade policy and higher input costs.

THE CONSUMER

What we know: Consumer health has been bifurcated with higher-income consumers holding up better than lower-income consumers. On the positive side, a stable labor market has supported the consumer, mortgage delinquencies are low and debt service ratios appear manageable. On the negative side, household debt is rising, consumer confidence is gloomy, and delinquencies on auto and credit card debt are rising. Moreover, student loan payments, which were suspended during the pandemic, have resumed.

What we don’t know: Will lower sentiment translate to lower spending? At what point would rising costs from tariffs create demand destruction among consumers?

Our view: The consumer still appears fairly healthy, but we see some vulnerabilities, particularly among lower-income consumers. We expect spending to slow from very elevated levels. We’ll be watching the wealth effect closely—it has been a large factor propping up spending over the past few years, and a sustained decline could foreshadow a larger pullback in spending.

Investment Grade & High Yield

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In thinking about potential impacts from tariffs, we are segmenting industry exposures into four buckets:

1. Directly impacted by the tariffs today.

- Those sectors directly impacted include auto manufacturers, auto suppliers, retailers and logistics providers.

- We have limited exposure here and do not currently see much value emerging, even with the recent underperformance.

- Generally, these sectors have not been in favor by the team as many are in the “Avoid Losers” pillar.

2. Indirectly impacted by tariffs largely through weaker global growth and/or inflationary pressure.

- These are sectors impacted by global growth concerns (i.e., second order of effect).

- Notable sectors include energy and other commodity-exposed industries, such as chemicals and metals & mining.

- Also impacted are consumer-exposed sectors, such as leisure and lodging, banking and consumer lending.

- Many of these names fit our “Upgrade Candidates” and “Cheap for Rating” pillars and we have been looking to add on weakness.

3. Risk from future tariffs or retaliation.

- Based on what we know today, and the situation is evolving rapidly, these are sectors that have generally held in thus far, including pharmaceuticals, tech hardware and semiconductors.

- These sectors have been fairly defensive in the selloff, but as a result, value has been slower to emerge as we look to add risk.

4. Limited or no impact from tariffs or secondary impacts.

- These include largely domestic industries and non-discretionary purchases.

- Sectors include cable & telecommunication, software, P&C brokers, aerospace & defense, air lessors and healthcare.

- Similar to #3, we have appetite to add to these sectors when value reemerges.

Opportunities/Risks We’re Watching

Up until this point, investment grade issuance has been very robust. In fact, the first quarter of 2025 is set to go on record for the highest issuance in the first quarter at $536 billion (vs. $525 billion in the first quarter of 2024). Dealers are waiting to see how the next few days play out before reassessing or revising their supply outlook for the calendar year 2025. We will continue to look to participate in new issues that we believe offer attractive new issue concessions.

Recent market volatility has generated opportunities in high yield credit due to increased risk premiums. Using our proprietary Credit Health Index (CHIN) model, we now expect losses over the next 12 months in the high yield market to increase to the range of 250-300 basis points (bps) (from approximately 200 bps at the start of the year). As a result, we believe value has emerged; high yield spreads are roughly 160 bps wider than February and now offer a level of compensation inconsistent with anticipated losses for the late-cycle stage of the credit cycle. We continue to be active in both primary and secondary markets across a variety of sectors as a result of the new opportunity set.

Core Plus

Current Positioning

We had already extended duration in anticipation of more onerous tariffs prior to the "Liberation Day" announcement (2 April). Persistent market dislocations have led us to add modestly to our duration stance, while also taking advantage of the sharp credit widening in investment grade and high yield, adding some selective exposure in issues that have repriced wider. This has been done both in the primary and secondary markets.

We also took advantage of the relatively strong agency MBS performance to shave exposure and build more liquidity in US Treasurys. Despite the retaliatory tariff pause, the ongoing escalation with China and the already in-place tariffs with other trading partners has made us more cautious over US growth prospects in 2025. This is reflected in our lower base-case and bear-case growth estimates and revised credit spread targets.

Currently, we are roughly six-tenths of a year long on a nominal basis and four-tenths of a year long on an empirical basis. In terms of key rate duration, we still have our largest overweight to the belly (5 to 10 years), but are now slightly overweight the 30-year as well to capitalize on what has been a significant dislocation in longer-dated Treasurys as leverage comes out of our rates markets.

Our overall government sector allocation remains highly liquid and defensive, with about two-thirds of the portfolio in US Treasurys and agency MBS.

Opportunities/Risks We’re Watching

While further bear steepening is possible, we believe our long-end exposure may prove to be an important hedge against greater deterioration in the US economy in conjunction with a Fed that chooses to remain sidelined due to nearer-term tariff inflation pressures.

We are currently assessing worst-case scenarios for growth and inflation and the likelihood of both market and policy responses to such scenarios as we digest new announcements of retaliation and/or efforts to negotiate by other countries.

Short Duration, Intermediate Duration, Core Fixed Income

Current Positioning

Our strategies have not changed risk positioning since the end of the first quarter. While spreads have increased over a short period of time, valuations are still near longer-term averages and have a distance to go before we see material value.

Opportunities/Risks We’re Watching

While bid/ask spreads have increased and valuations are not overly compelling, we are not inclined to add generic risk. We prefer to add securities we believe offer idiosyncratic value.

The primary market remains subdued. We look forward to observing where risk clears when the market reopens under normal conditions.

We remain vigilant and have room in our risk budget to add market exposure if and when valuations become favorable. We prefer to add over the near term when we find securities with specific cheapness or value.

Investment Grade Corporate

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

Portfolio overweights include:

- Financials, banks and life insurers, which are industries that are generally insulated from the direct impact of tariffs, but are sensitive to the economic impact.

- Technology industry on a risk-weighted basis. We expect relative insulation from tariff impact, but believe hardware companies that have manufacturing facilities or partners producing goods in China and Mexico could be impacted.

Portfolio underweights include:

-

Automotive

-

US retailers

Investment grade issuance has been robust this year. Investment grade issuers tend to be sensitive to broader macro volatility, which could result in some slowing of the new issue pipeline as news is digested; up until last week it had been business as usual for IG issuance.

Opportunities/Risks We’re Watching

In the near term, we expect market volatility to impact portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Long Duration

Current Positioning

We continue to believe that long-term corporate spread valuations are unattractive, trading below their 10- and 15-year averages. Long corporate option-adjusted spreads (OAS) have widened based on the shift in market sentiment but remain below their long-term historical averages.

As a result of less attractive spread valuations and late-cycle concerns, we have been keeping our sensitivity to credit risk at the low end of our risk range. Further spread widening on the back of slower economic growth and/or recessionary pressures would provide an opportunity to increase the credit beta in the strategy.

Within the long credit strategies, we maintain an allocation to Treasurys as a source of liquidity to take advantage of future opportunities. We also recently added about 0.3 years of duration versus the benchmark across the long duration strategies given our anticipation of a decline in economic activity.

Opportunities/Risks We’re Watching

Further spread widening on the back of slower economic growth and/or recessionary pressures would provide an opportunity to increase the credit beta in the strategy. Our philosophy is to take the appropriate amount of risk when spreads offer attractive value and then reduce risk during periods of spread tightening. Our strategy is currently well positioned for a flight-to-quality bid in the market as we've seen in recent weeks.

Multi-Asset Credit

Current Positioning

We had already been moving up in quality within credit and had some credit protection on. During April, we continued on this theme, reducing some exposure to BBB-rated investment grade credit. We increased our emerging markets allocation during the month as the asset class has benefited from de-dollarization flows. We believe the US dollar is overvalued by about 10% on a multi-year horizon and will look to increase non-USD allocations. Additionally, with the US dollar falling, we maintained and added to several non-US dollar positions in both developed and emerging markets.

Opportunities/Risks We’re Watching

On technicals, we believe that uncertainty and volatility will be here for a while. In our view, tariff uncertainty has been postponed, not resolved, and trade deals typically take years to negotiate, not days or months.

On fundamentals, we expect underlying growth trends to continue to slow and that a pending supply shock will materialize as container ships to the US start to fall. However, we believe this may be offset by accommodative fiscal policy in the form of tax cuts, though the timing is unlikely to line up perfectly.

On valuations, we think the current retracement from prior wides may have overshot, or is more fair now. Emerging markets remain attractive relative to developed markets, particularly US-denominated assets for hedged foreign investors.

Overall, we will seek to take advantage of specific opportunities as they arise but are fairly comfortable with our existing asset allocation. We remain constructive on the non-US dollar trade.

Emerging Markets Debt

Current Positioning

Given President Trump’s position on trade and the team’s heightened concerns on tariffs, we entered the year defensively positioned with a bias towards Latin America. Expectations for a continuation of elevated US Treasury volatility drove the team’s mostly neutral duration positioning.

We continue to assess our corporate positioning in relation to the evolving tariff regime, as well as expectations for global growth and commodity pricing.

The ability of emerging market countries to address weaker external demand via domestic policy is a critical consideration for corporates. Post-“Liberation Day,” price dislocations in selected markets have allowed us to add risk opportunistically to our preferred names.

Opportunities/Risks We’re Watching

Asia stands out as the most exposed to the US tariff regime and to slowing growth in China. The Street is now estimating that the trade war could drag down Chinese growth by about 1%. In the face of these headwinds, we see Chinese policymakers acting aggressively to support domestic demand. China is likely to implement near-term countercyclical measures, including front-loading economic stimulus, expanding fiscal deficits and implementing additional interest rate cuts to support growth.

Outside of China, we expect EM countries facing reciprocal tariffs to come to the negotiation table. We also see EM Asia ex-China as benefiting from the lower oil price and from both monetary and fiscal room to address growth headwinds.

Many core emerging market countries in Africa, EM Europe, Latin America and the Middle East are more insulated from the first-order impact of tariffs. Most are subject to the lower 10% baseline, have more domestically focused economies, trade more with Europe than the US, or export hydrocarbons/minerals, which remain exempt from country tariffs.

Overall, the reorientation of supply chains and the reconfiguration of trade may present opportunities for some emerging market countries, while presenting headwinds for others. For example, there is little doubt that Latin America will benefit from an agricultural perspective as China pulls back from US supply.

Investment Grade & High Yield

Current Positioning

We were defensively positioned during much of 2024 in both portfolios. We have been overweight non-cyclicals and higher-rated companies and underweighting cyclicals and BBB-rated companies.

In our Investment Grade strategy, we limited high yield exposure (less than 2%).

Following “Liberation Day,” our credit market outlook score declined, and we lowered the targeted beta range in both strategies:

- Investment Grade to 96-101% from 98-103% previously.

- High Yield 91-96% from 93-98% previously.

Opportunities/Risks We’re Watching

We are watching investor sentiment; a more positive outlook could move our “technicals score" into more positive territory. This would likely result in a higher targeted beta range.

In high yield, there has been meaningful spread dispersion taking place. For example, lower tier-two investment grade-rated bonds from banks and insurance companies have been outperforming BB-rated bonds issued by non-financial companies. Spreads on bonds issued by companies operating in more cyclical sectors such as automotive and chemicals have widened materially more than bonds of telecom operators. Given the increased spread dispersion, we see opportunities to rotate some positioning in our portfolio, all the while maintaining an overall defensive positioning from a beta perspective.

Other developments that could change our positioning include:

- A stated willingness on the part of the US to reduce the planned tariffs for those countries that are open to work with it toward removing tariff and non-tariff barriers to trade;

- The formation of a German government that intends to use large-scale fiscal stimulus to address the country’s deficiencies in its military capabilities, as well as its digital and physical infrastructure;

- Central banks’ responses to the slowdown in global trade and the (dis-)inflationary shock that a potential trade war creates.

Global Bond

Current Positioning

Our Global Bond strategy was slightly overweight credit heading into the second quarter, and we have been increasing that overweight into the spread weakness. We have been positioned slightly long US duration and have been extending duration through the rate backup. Active currency positions have cushioned short-term underperformance from credit and duration.

Our relative credit beta overweight increased from low levels by about 25% since the reciprocal tariff announcement.

- We added exposure in banks, technology, energy and communications.

- In high yield-eligible accounts, we added to select BB-rated issuers.

We maintain a US dollar underweight achieved via overweights to the British pound, Japanese yen and euro.

With global growth continuing to be threatened, we maintain a long-duration bias and extended US duration again into last week’s volatility.

Opportunities/Risks We’re Watching

We are also trying to increase purchases into this weakness and bid-offer spreads are highly volatile. We continue to monitor the market for relative value and liquidity with a bias toward continuing to use weakness to increase credit risk across all portfolios.

Global Credit

Current Positioning

Our Global Credit strategy has been slightly overweight credit, and we are increasing that overweight into the spread weakness and volatility.

Our modest relative credit beta overweight has increased by about 30% since the since the reciprocal tariff announcement.

- We added exposure in banks, technology, energy and communications.

- In high yield-eligible accounts, we added to BB-rated issuers.

Opportunities/Risks We’re Watching

We continue to monitor the market for relative value and liquidity with a bias towards continuing to use weakness to increase credit risk across all portfolios.

Current Positioning

We had already extended duration in anticipation of more onerous tariffs prior to the Liberation Day announcement (2 April). Persistent market dislocations have led us to add modestly to our duration stance while also taking advantage of the sharp credit widening in investment grade and high yield, adding some selective exposure in issues that have re-priced wider. This has been done both in the primary and secondary markets.

We also took advantage of the relatively strong agency MBS performance to shave exposure and build more liquidity in US Treasurys. Despite the retaliatory tariff pause, the ongoing escalation with China and the already in-place tariffs with other trading partners has made us more cautious over US growth prospects in 2025. This is reflected in our lower base case and bear case growth estimates and revised credit spread targets.

Currently, our nominal duration is about 0.5 year long, while our empirical duration is shorter at just +0.25 years. In terms of key rate duration, we still have our largest overweight to the belly (five-10 years), but are now slightly overweight the 30-year as well, to capitalize on what has been a significant dislocation in longer-dated Treasurys as leverage comes out of our rates markets.

Our overall Government sector allocation remains highly liquid and defensive, with about 2/3s of the portfolio in USTs and Agency MBS.

Opportunities/Risks We’re Watching

While further bear steepening is possible, we believe our long-end exposure may prove to be an important hedge against greater deterioration in the US economy in conjunction with a Fed that chooses to remain sidelined due to nearer-term tariff inflation pressures.

We are currently assessing worst-case scenarios for growth and inflation and the likelihood of both market and policy responses to such scenarios, as we digest new announcements of retaliation and/or efforts to negotiate by other countries.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

We are slowly starting to pick away at potential credit opportunities Many more bids for risk than offers so far, which is typical in these very volatile environments. There is an element of price discovery taking place today.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Current Positioning

Following month-end, we slightly reduced our relative beta overweight, reducing recent new issue bonds ahead of the tariff announcements.

In the near term, we expect to see market volatility which will have impacts on portfolio performance. However, we do not plan to make significant changes to positioning at this time.

Disclosure

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Markets are extremely fluid and change frequently.

Diversification does not ensure a profit or guarantee against a loss.

Past market experience is no guarantee of future results.

8082161.1.3