What is the Credit Cycle Telling Us?

Our Takeaways

(Looking Out Six Months)

- The potential for a more accommodative central bank policy, stronger profits and healthier productivity have dampened the odds of a downturn.

- We believe the credit cycle is in mid-expansion, and economic indicators suggest it could continue into the second half of 2024.

- The economy has more runway and the risk trade has potential to perform well in this phase of the cycle.

Graphic Source: Loomis Sayles. Views as of 21 June 2024. The graphic presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Mid-Expansion Dynamics

While the lagged effects of tighter monetary policy will likely cool the US economy, supply-side dynamics like an expanding labor force should continue to support growth. Consumers are still spending and corporate profits are ticking back up; the rolling recessions that we’ve seen in some sectors (e.g., technology, housing, profits, manufacturing) have seemingly come to an end.

The disinflation trend remains intact despite the stronger numbers reported earlier in the year. Ultimately, looser labor markets should continue to push down wage growth, which should eventually feed into services disinflation. The Federal Reserve (Fed) does not want to engineer a recession with overly restrictive policy; while timing of Fed cuts is still uncertain, the market appears convinced that the next move for the fed funds rate is down.

A Closer Look

Credit cycle analysis involves measuring the changing factors that influence a cycle’s movement and tracking the complex interactions between credit and asset prices. We use our credit cycle framework to interpret data and shape our views on where a country, sector or issuer may be in the cycle. We keep in mind the variability of indicators since they can shift in large and small ways and undermine or bolster market sentiment and valuations.

Interpreting the Cycle

The key economic indicators in the following table tend to behave differently in each phase of the credit cycle. Currently, most of these indicators display expansion/late cycle characteristics. However, we do not interpret indicators at face value and make a conclusion. Our determinations incorporate art and nuance. We believe the cycle is in mid-expansion with expectations of softer for longer growth—we have extended the runway for this cycle based on expectations for easing Fed policy, continued profit strength and healthy productivity.

In terms of putting capital to work, as long as disinflation continues with monthly prints trending 0.2% or less and the next move in fed funds is lower, we think risk appetites can stay strong and spreads could tighten to new lows.

Table Source: Loomis Sayles. Views as of 10 June 2024. Highlighted cells represent attributes we’re currently observing. Lighter blue represents attributes typical of expansion/late cycle and navy blue represents attributes typical of downturn. The table presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and therefore, should not be the basis to purchase or sell any securities.

What if...?

Because macroeconomic factors don’t always behave as expected, we prepare alternative scenarios and those include indicators to watch:

Late Cycle/Rate Shock

In this scenario, the economy continues to chug along at an above-trend pace of growth driven by strong demand-side dynamics.

- Excess demand causes disinflation to stall out as services inflation proves to be sticky (further increases in oil prices could also play a role).

- Consumers hold in strong; they still have jobs and feel positive impacts from improved wealth.

- Profits rebound continues, and margins expand as firms hold on to pricing power.

- Although monetary policy may seem restrictive at first glance, the ballooned deficit and impacts from an overly expansionary fiscal policy offset monetary tightness, allows the economy to continue to run hot.

In this scenario, the Fed’s hands are tied with a strong economy, labor market and stubborn inflation; no rate cuts on the horizon and fears of further hikes could start to creep into the market. This scenario acknowledges the potential for fed funds hikes and bond yields to push past 5.0%.

Late Cycle/Growth Scare

This is a softer growth scenario that could be the precursor to an eventual downturn.

- We have witnessed a historic Fed tightening cycle and real rates are elevated by historical standards, suggesting there are some vulnerabilities in the economy and the market.

- Despite plenty of warning signs, we don’t see much in real economic data that points toward an actual recession in the near term.

A true downturn has become a lower-probability event within our six-month horizon, but this scenario accounts for the risk of the market “readying” for a downturn in reaction to softer economic prints or exogenous shocks with risk-off sentiment and a soft rally in rates.

US Consumer

Our view: Overall consumer spending in the US still remains healthy and should be additive to economic growth.

The details: Higher-income households continue to spend at favorable rates. Lower-income households, a much smaller segment of total spending, are showing weakness.

Global Growth

Our view: Economic growth could ease in the US and the euro area, however labor strength should support consumption. China’s recovery will likely be protracted.

The details: The US and euro area have been experiencing disinflation. Markets look poised for central bank cuts. An extended property-market downturn and subdued consumer spending continued to weigh on China’s overall economic health.

US Monetary Policy

Our view: While the timing is uncertain, we expect the Fed to cut rates twice this year.

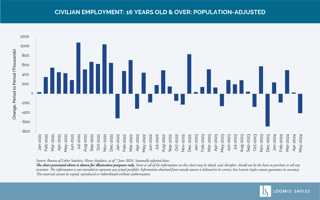

The details: We expect that inflation will continue its disinflationary trend. A further rise in the unemployment rate could cause the Fed to cut rates more aggressively. The gradual drift higher in unemployment has been unusual as it usually spikes higher at this point in the cycle.

US Corporate Profits

Our view: First quarter earnings reports have been off to a decent start with growth at +4.7% versus +3.8% consensus.i

The details: Earnings per share estimates for 2024 have been approximating +8% growth. Stronger-than-anticipated economic data and solid margins have been the drivers.

US Credit Risk Premium/Risk Appetite

Our view: Similar to 2023, gross domestic product (GDP) growth expectations for 2024 have steadily risen, which, in our view, has been a critical factor supporting riskier corporate credits.

The details: Given the "risk-on" environment of the past 12 months, we view credit spreads as tight. While a soft landing scenario could allow spreads to remain in a tight range, the odds that spreads leak wider over the next 6 to 12 months remain elevated.

Inflation

Our view: US disinflation trend appears to be intact.

The details: We are watching service-sector inflation to decline, which typically requires further wage disinflation. This would be difficult to achieve without a softer labor market.

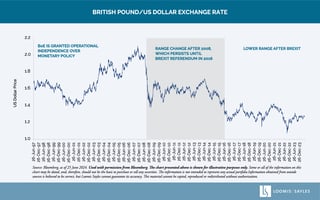

The US Dollar

Our view: The dollar is likely to weaken once the Fed’s cutting path is clearer. Until then we could see a fairly tight range-bound FX market.

The details: A few lighter-than-expected inflation prints could usher in the soft landing and a weaker dollar.

China

Our view: A protracted property market downturn and subdued consumer spending are weighing on the economy's recovery.

The details: Despite positive data surprises in exports and PMIs, insufficient domestic demand still remains a challenge for China's recovery.

Geopolitics

Our view: For the time being, we do not expect geopolitics to have a material effect on the credit cycle.

The details: Countries involved in war face idiosyncratic risks; however, we do not believe wars in the Ukraine and Middle East will have a substantial effect on global growth or inflation at this juncture. We are continually assessing this view as geopolitical situations can unfold in unexpected ways.

Endnotes

i Bloomberg, as of as of 10 May 2024.

Disclosure

All insights and views are as of 18 June 2024, unless otherwise noted.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Commodity, interest and derivative trading involve substantial risk of loss.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Markets are extremely fluid and change frequently.

Past market experience is no guarantee of future results.

SAIFgi5auqdr

Investment Outlook

Investors’ risk appetites should remain strong as central banks ease policy in response to lower inflation.

Broadly speaking, ongoing expectations of artificial intelligence’s (AI) transformative impact on the global economy could bolster investor sentiment during the next 6 to 12 months, and potentially much longer.

We believe certain sectors of the market, most notably growth equity, are likely to outperform other asset classes on the back of increased technology investment. That has been the case over recent history, but looking forward we expect positive absolute performance to broaden out.

Visit Our LandScape Blog.

Loomis Sayles analysts are career professionals who offer deep knowledge and experience in a diversity of global asset classes and market sectors.

The power of our credit cycle framework lies in the common language it provides to help investors identify relative value opportunities across the globe.