What’s Next for the Credit Cycle?

BY TOM FAHEY, CO-DIRECTOR OF MACRO STRATEGIES, AND TYLER SILVEY, CFA, GLOBAL

MACRO STRATEGIST, ASSET ALLOCATION

Key Takeaways

- Trying to forecast the economy with flip-flopping tariffs and trade policy is like building a house on shifting sands—it’s hard to feel confident without a solid foundation. We expect significant uncertainty to persist. Attention has turned to the tax and reconciliation bill moving through the US Congress.

- It may take time for the impact of tariffs to show up in economic data. First-quarter reported earnings were generally strong, but trade disruption is weighing on the outlook for credit. Profits and consumption are key indicators to watch, in our view.

- We believe the US economy can avoid a downturn in the near term, but we expect slower growth and higher inflation. We expect elevated volatility to continue.

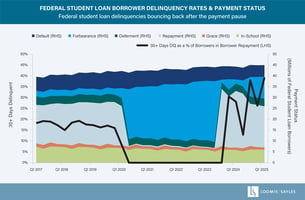

Graphic Source: Loomis Sayles. Views as of 11 June 2025. The graphic presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Volatile Dynamics

In our view, the US economy has been resilient, bolstered by strong profits and a strong labor market. Inflation has moderated, but we are anticipating a temporary surge from tariffs. The Federal Reserve has paused its cutting cycle at restrictive levels. The Fed appears to be in wait-and-see mode for now.

Significant policy uncertainty and massive supply disruptions from tariffs will likely disrupt investment spending. Companies involved in international trade may reevaluate their supply chains. We also expect tariffs to crimp housing supply as costs increase.

We will be watching corporate health very closely. Our most recent survey of Loomis Sayles’ credit analysts (our Credit Analyst Diffusion Indices, or CANDIs), conducted in early April during the height of tariff turmoil, revealed a weakening outlook for corporate health. The Loomis Sayles Credit Health Index (CHIN) is currently at a healthy level consistent with late cycle.

We believe profits are one of the most important indicators to watch because they drive the cycle. If declining demand or increased costs hit margins and profits turn negative, then companies are likely to start shedding labor. A rise in unemployment is a key signal for the downturn phase of the credit cycle.

A Closer Look

In our view, credit cycle analysis requires art and science. We track key economic indicators that tend to behave differently in each phase of the cycle, and put them into context using our credit cycle framework and collective experience. Currently, these indicators appear divided between expansion/late cycle and downturn. We believe the credit cycle remains in late cycle based on the strength of bottom-up fundamentals. At this stage of the cycle, investors tend to focus on capital preservation and moving up in quality.

Table Source: Loomis Sayles. Views as of 11 June 2025. Highlighted cells represent attributes we’re currently observing. Green represents our current view. Bright blue represents the previous view (if different from the current view). Arrows indicate the direction of change in view where applicable. The table presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and therefore, should not be the basis to purchase or sell any securities.

What’s Next?

Because macroeconomic factors don’t always behave as expected, we prepare scenarios for the path of the US credit cycle over the next six months. Here, we outline three potential scenarios and indicators to watch:

Base Case

Late Cycle/Stallflation

- In this scenario, the economy shifts toward the edge of late cycle, but does not slip into recession.

- Stagflation gets talked about a lot, but we believe that term implies a 1970s scenario with a much more bearish shading to inflation, unemployment and asset prices than what we currently anticipate. We prefer “stallflation” for this scenario because we see real GDP growth slowing toward “stall speed,” around 0% - 1%, as the economy adjusts to a historically high tariff rate.

- Fears of trade war escalation recede, but volatility and uncertainty continue.

- Earnings growth slows down, but companies entered this period with solid profitability, which should help to limit layoffs.

- Inflation ticks up while unemployment only drifts marginally higher, preventing the Fed from cutting too aggressively.

Alternative Scenario

Late Cycle/Off-Ramp

- This scenario acknowledges the potential for stronger risk appetite if an enduring off-ramp from the trade war emerges. Potential off-ramps include significant trade deals or court action.

- Potential tax cuts could provide relief for markets and prop up growth expectations.

- Growth stabilizes at or above 1.5% annual real GDP growth, profits remain strong and unemployment stays low.

- Inflation moves higher as baseline tariffs stay in place and the strong labor market prevents demand destruction. The Fed stays on hold.

Alternative Scenario

Downturn

- In this scenario, profits go negative or undershoot consensus expectations by 10% to 15%, leading to layoffs and a sharply higher unemployment rate above 5%. A rise in the unemployment rate is a lagging indicator, but it defines a recession.

- Uncertainty remains elevated and many companies pause investment plans. Consumer confidence is poor and the wealth effect would fade as equity markets drop; spending pulls back.

- Inflation rises in the near term, but demand destruction ultimately levels it out. Risk appetite plunges and the Fed cuts.

The US Consumer

Our view: The consumer still appears fairly healthy in aggregate, but we see some vulnerabilities, particularly among lower-income consumers.

The details: Higher-income households continue to spend at favorable rates. Lower-income households, a much smaller segment of total spending, are showing weakness. The tax bill looks like it will benefit middle- to upper-income households more so than lower income. We expect spending to slow from very elevated levels given uncertainty and higher inflation. We’ll be watching the wealth effect closely—it has been a large factor propping up spending over the past few years.

Global Growth

Our view: Undefined trade implications continue to hang over the global economy. Encouragingly, many countries have the ability to increase fiscal spending to support their economies if needed.

The details: In our view, the risk of global trade seizing up and causing widespread recession has diminished. However, we expect trade uncertainty to continue for some time. Countries could forge new trade relationships with the US in the meantime, which would likely be viewed favorably by financial markets.

US Monetary Policy

Our view: We think the Federal Reserve is in a bit of a bind. On the one hand, the labor market remains firm, and weekly initial jobless claims have been low. On the other hand, consumers expect higher inflation as tariffs work their way through the economy. The Fed seems to be taking a wait-and-see approach for now.

The details: We expect inflation to continue its disinflationary trend after a temporary jump from tariffs. So far, the labor market slowdown has been driven by lower job openings rather than falling payrolls or layoffs. We may see the unemployment rate rise further as firms ease up on hiring, but mass layoffs seem unlikely unless corporate profits take a big hit. We think the Fed would respond to a clear rise in the unemployment rate with further rate cuts. Until then, the Fed is likely to stay on hold. We think the Fed probably has enough confidence in the disinflationary trend that it would respond to a rise in the unemployment rate with further rate cuts.

US Corporate Profits

Our view: First-quarter earnings growth was very strong, handily beating expectations. Consensus expectations for 2025 have slid to the mid-single digits, which we think is achievable.

The details: We believe earnings growth can broaden out across sectors later this year, but near-term challenges persist, particularly for energy and materials. Mega-cap tech earnings-per-share (EPS) growth is slowing, but consensus still expects double-digit growth year over year. We believe “rest of market” EPS growth will be challenged near term.

US Credit Risk Premium/Risk Appetite

Our view: Credit spreads were very tight at the start of 2025. We saw a short-lived spike in early April as tariff panic dominated market narratives, but the retracement since then has been impressive. Risk premiums look tight.

The details: Tight credit spreads have led us to look for value in other segments of the fixed income markets. We would view further spread widening as an opportunity because all-in yield remains attractive.

Inflation

Our view: Tariffs should interrupt the disinflation trend.

The details: Goods inflation looks likely over the near term. However, we are seeing a cooling labor market, which could contribute to softening wage growth and services inflation. If the unemployment rate drifts higher as we expect, we believe inflation will ultimately resume its downward trend, allowing the Fed to lower interest rates.

The US Dollar

Our view: We believe the US dollar is overvalued; it appears the US administration would welcome a weaker dollar.

The details: Consensus growth expectations for the US have been marked down relative to other countries as the US exceptionalism story seems to fade. We are getting more bullish on non-dollar assets, including some G10 currencies.

China

Our view: The effective US tariff rate on China has been reduced significantly after the sharp escalation in April, and is now at a more manageable, non-prohibitive level, in our view.

The details: China’s tariff reprieve could prompt further front-loading of shipments and production, helping to alleviate tariff-related drags on China’s growth. We believe Beijing is less likely to pursue significant additional stimulus, taking a wait-and-see approach instead. Overall, we believe a durable resolution remains challenging.

Disclosure

All insights and views are as of 11 June 2025, unless otherwise noted.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Commodity, interest and derivative trading involve substantial risk of loss.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Markets are extremely fluid and change frequently.

Past market experience is no guarantee of future results.

SAIFd465iydz

Visit Our LandScape Blog.

Loomis Sayles analysts are career professionals who offer deep knowledge and experience in a diversity of global asset classes and market sectors.

The power of our credit cycle framework lies in the common language it provides to help investors identify relative value opportunities across the globe.