What’s Next for the Credit Cycle?

BY TOM FAHEY, CO-DIRECTOR OF MACRO STRATEGIES, AND TYLER SILVEY, CFA, GLOBAL

MACRO STRATEGIST, ASSET ALLOCATION

Key Takeaways

- We believe the credit cycle will remain in the expansion phase, supported by healthy risk appetite, strong corporate health and fiscal policy.

- We expect a short-lived economic soft patch given the US government shutdown and tariff impacts, but lower policy rates and a positive fiscal impulse could contribute to a growth rebound in early 2026.

- Despite cooling labor market data, we are not expecting a massive wave in layoffs. We view corporate health as the lynchpin behind the labor market, and corporate earnings have been strong.

- We think the Federal Reserve (Fed) will continue cutting rates, though less aggressively than markets initially predicted. Fed policy could support a “Goldilocks” scenario with lower rates, stable growth and eventually a resumption of disinflation.

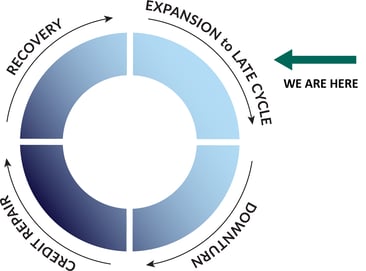

Graphic Source: Loomis Sayles. Views as of 1 December 2025. The graphic presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and, therefore, should not be the basis to purchase or sell any securities. Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Expansionary Dynamics

We expect moderate GDP growth of around 2% in the first half of 2026. US growth will likely slow in Q4 2025 influenced by tariffs, uncertainty and the government shutdown, but we believe the positive fiscal impulse, lower policy rates and continued strength in earnings sets the stage for stronger growth in the months ahead. If tariffs ordered through the International Emergency Economic Powers Act (IEEPA) are deemed illegal, any refunds delivered to US businesses could act as a de facto fiscal stimulus (though there is uncertainty about timing and implementation). US inflation and employment data are likely to be distorted through year-end 2025 due to the government shutdown, but we expect the Fed to continue cutting rates in 2026. However, the pace may be less aggressive than markets had initially predicted.

Labor market data has been cooling, but we do not expect a massive wave in layoffs as long as corporate health remains solid. Corporate earnings have been strong. Our most recent survey of Loomis Sayles’ credit analysts (our Credit Analyst Diffusion Indices, or CANDIs), conducted in September, showed improving expectations for profit margins and leverage. The Loomis Sayles Credit Health Index (CHIN) is currently at a level consistent with expansion / late cycle.

We believe profits are one of the most important indicators to watch because they drive the cycle. If declining demand or increased costs hit margins and profits turn negative, then companies are more likely to start shedding labor. As long as profits remain broad-based and positive, we anticipate a fairly “Goldilocks” environment for risk assets, with some pockets of volatility.

A Closer Look

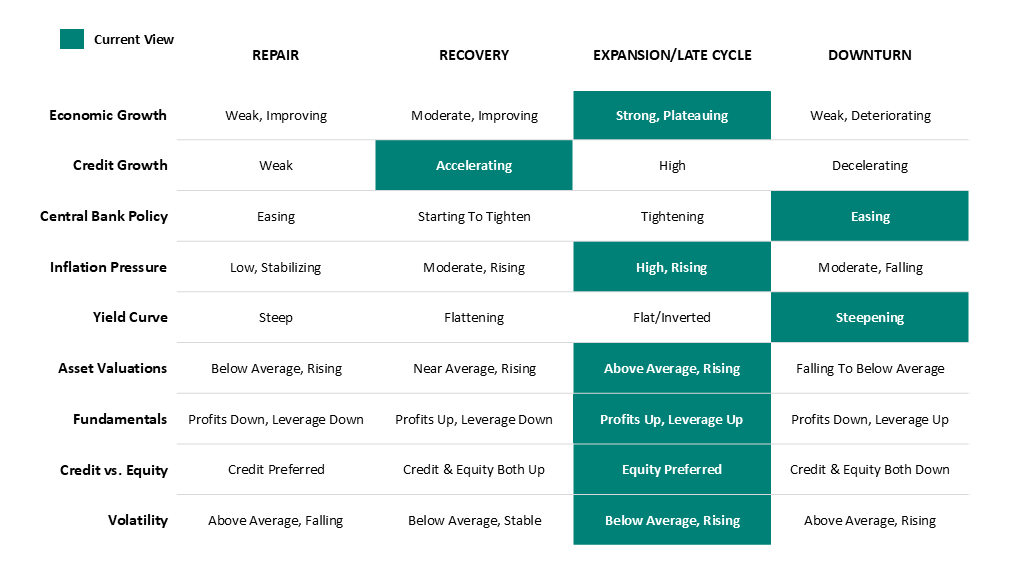

In our view, credit cycle analysis requires art and science. We track key economic indicators that tend to behave differently in each phase of the cycle, and put them into context using our credit cycle framework and collective experience. Currently, these indicators primarily fall within expansion/late cycle. We believe the credit cycle remains in this phase of the cycle based largely on the strength of bottom-up fundamentals. At this stage of the cycle, investors tend to focus on capital preservation and moving up in quality.

Table Source: Loomis Sayles. Views as of 1 December 2025. Highlighted cells represent attributes we’re currently observing. Green represents our current view. Bright blue represents the previous view (if different from the current view). Arrows indicate the direction of change in view where applicable. The table presented is shown for illustrative purposes only. Some or all of the information on this chart may be dated, and therefore, should not be the basis to purchase or sell any securities.

What’s Next?

Because macroeconomic factors don’t always behave as expected, we prepare scenarios for the path of the US credit cycle over the next six months. Here are three potential scenarios and indicators to watch:

Base Case

Expansion/Resilient

- In this scenario, strong corporate earnings, rate cuts and fiscal policy support solid growth.

- The labor market cools with softer supply and early signs of weakening demand, but strong corporate profits help limit large-scale layoffs.

- Inflation may show some upward momentum from goods prices, but eventually resumes a downward trend as tariff impacts roll off.

- The door is open for a couple of Fed rate cuts and risk appetite remains positive.

Alternative Scenario

Late Cycle/Economic Boom

- This scenario recognizes further upside for the US economy fueled by the potential for a higher fiscal multiplier, tariff rebates (which would act as a stimulus), elevated capital expenditures, and/or strong consumer spending among higher-income consumers.

- Profits remain elevated, unemployment is low, and inflation remains sticky near 3% given the strong demand backdrop.

- The Fed takes a more cautious stance and pauses rate cuts.

- Risk assets rally given the strong macroeconomic backdrop, though rising yields could spark market volatility.

Alternative Scenario

Downturn

- In this scenario, after an unprecedented trade shock and a period of restrictive rates, the labor market starts to show more signs of softening (which could move in a non-linear fashion). Companies consider shedding labor to protect margins, especially with higher input costs.

- A sustained correction in the equity market diminishes the wealth effect, hitting the higher-income consumers that have been supporting aggregate consumer spending, and consumption rolls over.

- The Fed cuts rates, yields rally and risk assets sell off.

The US Consumer

Our view: The consumer still appears fairly healthy in aggregate, but we see some vulnerabilities, particularly among lower-income consumers.

The details: Higher-income households continue to spend at favorable rates. Lower-income households, a much smaller segment of total spending, are showing weakness. The One Big Beautiful Bill Act is expected to benefit middle- to upper-income households more than lower-income households. Spending may slow from very elevated levels given uncertainty and inflation. We’ll be watching the wealth effect closely—it has been a large factor propping up spending over the past few years.

Global Growth

Our view: Shifting global trade dynamics continue to hang over the global economy. We view tariffs as a tax on growth. Encouragingly, many countries have the ability to increase fiscal spending to support their economies if needed.

The details: In our view, the risk of global trade seizing up and causing widespread recession has diminished. Although we have more clarity on tariff policy, uncertainty around the legality of IEEPA tariffs[i] and future tariff policy remains. Current tariff rates are much more elevated than expected at the beginning of 2025 and we may see some friction as the global economy adjusts.

[i] Tariffs imposed with the use of the International Emergency Economic Powers Act.

US Monetary Policy

Our view: We think the Federal Reserve (Fed) will continue cutting rates, though less aggressively than markets initially predicted.

The details: The US government shutdown has muddied the data, but a softer labor market and subdued inflation should pave the way for additional rate cuts.

US Corporate Profits

Our view: Corporate earnings growth has been very strong, handily beating expectations. We expect equity earnings-per-share (EPS) growth to remain solid through year-end 2025 and into 2026.

The details: We believe earnings growth can broaden out in 2026, and large-cap earnings could potentially achieve double-digit growth rates for the year.

US Credit Risk Premium/Risk Appetite

Our view: Credit spreads were very tight at the start of 2025. We saw a short-lived spike in early April as tariff panic dominated market narratives, but the retracement since then has been impressive. Risk premiums look tight.

The details: Credit fundamentals still look solid and the technical backdrop has helped push spreads to tight levels. Compressed credit spreads have led us to look for value in other segments of the fixed income markets. We would view further spread widening as an opportunity because all-in yield remains attractive and aggregate credit fundamentals still look relatively healthy.

Inflation

Our view: We expect US inflation to continue rising over the next few months, then begin to ease as 2026 progresses.

The details: We may not be seeing the inflation surge that was feared, but signs of tariff impact are beginning to show in goods prices. On the flip side, we believe the cooling labor market could contribute to softening wage growth and services inflation. If the unemployment rate drifts higher as we expect, we believe inflation will ultimately resume its downward trend toward the Fed’s 2% target.

The US Dollar

Our view: We believe the US dollar has room to drift lower; it appears the US administration would welcome a weaker dollar.

The details: A softening US labor market, additional Fed rate cuts and continued policy uncertainty should help prevent a dollar rally, in our view. We maintain a favorable view on non-US-dollar assets, including some G10 currencies.

China

Our view: Despite a tariff reprieve, China’s economy is characterized by outright deflation, reflecting a lack of domestic demand and a sluggish labor market. We still have questions about the quality and sustainability of growth moving forward.

The details: We believe that China has overstretched across several key dimensions, creating a self-reinforcing cycle of economic weakness. China’s growth is set to slip further in Q4 2025, with some drag from export growth payback. With slower growth, policymakers show little interest in strengthening the country's currency, prioritizing the revival of inflation and corporate profits amid deflationary pressures.

Disclosure

All insights and views are as of 1 December 2025, unless otherwise noted.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Commodity, interest and derivative trading involve substantial risk of loss.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Markets are extremely fluid and change frequently.

Past market experience is no guarantee of future results.

8210502.1.3

Visit Our LandScape Blog.

Loomis Sayles analysts are career professionals who offer deep knowledge and experience in a diversity of global asset classes and market sectors.

The power of our credit cycle framework lies in the common language it provides to help investors identify relative value opportunities across the globe.