The absence of inflation pressure paves the way for global central banks to ease.

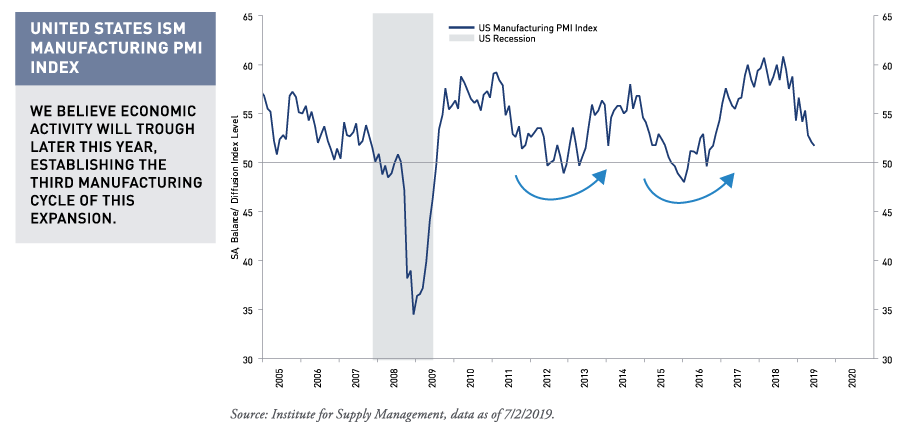

Weak economic data, particularly in manufacturing, may continue over the near term. However, we believe this manufacturing-driven slowdown will reverse course in the second half of the year without a recession.

Consensus GDP growth forecasts have been downgraded across developed and emerging market economies, but the absolute levels of real GDP still look decent.

Labor market strength should persist along with rising wages. We do not expect these conditions to result in higher consumer price inflation as they have in past expansions.

We expect the Federal Reserve (Fed) to cut its key policy rate twice in 2019. Meanwhile, other central banks with negative policy rates, like the European Central Bank and Bank of Japan, may embark on new easing initiatives.

Monetary policy easing should curb the current slowdown in economic activity. We believe a cyclical upturn will be underway by year-end, extending the runway for this expansion into 2020.

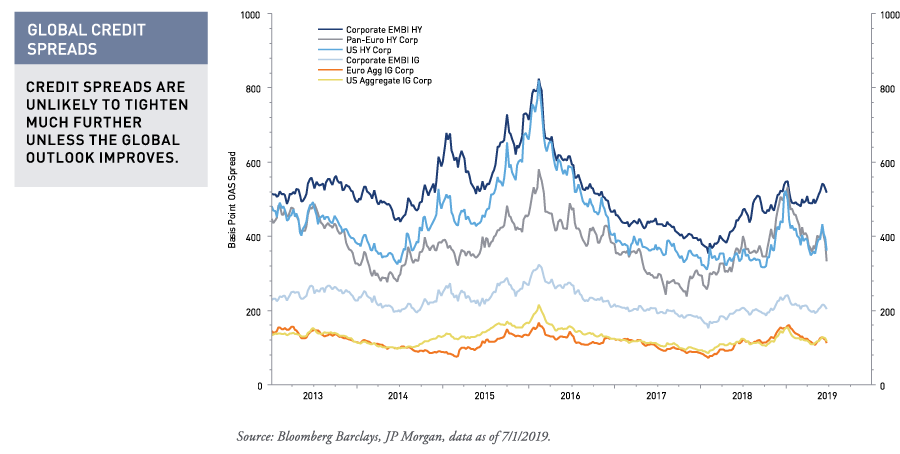

Credit spreads may not tighten much further, unless corporate profits and economic activity deliver upside surprise.

Expected default rates remain low, global growth is decent and 2019 corporate earnings are likely to rise in the low-single-digit range. However, we don’t expect credit spreads to revisit the lows seen earlier in the expansion.

Consensus estimates for 2019 corporate earnings could still be too high, especially if the second-half rebound in global growth develops slower than we expect.

We believe credit spreads are currently near fair value, given the amount of economic and political risk embedded in the forward outlook. Any changes in the outlook, positive or negative, could impact the trading range for credit spreads.

Credit investors should be able to harvest some yield and modest excess returns, as long as corporate profits and the global economy continue to expand.

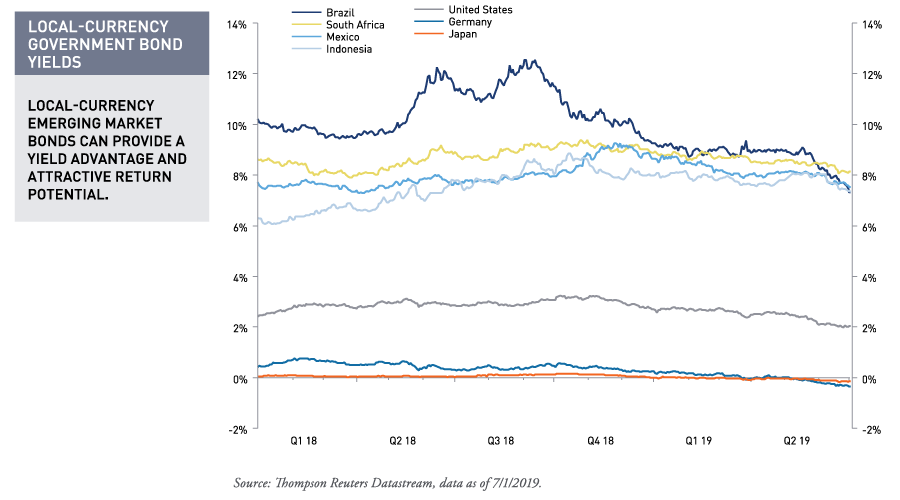

Dovish forward guidance from central banks pushed global rates to multi-year lows. In our view, local-currency emerging market bonds remain a preferred source of yield.

Inflation pressure in the US remains nonthreatening and the global growth outlook has softened, which gives the Fed some clearance to cut interest rates.

The market expects the Fed to cut over 75 basis points from the federal funds rate over the next 12 months. We think market pricing is too aggressive, but we do expect two 25-basis-point cuts to take place in July and December of this year.

In our view, the global economy is approaching the tail end of a soft patch within a long expansion. We expect a pickup in economic activity in the months ahead. However, we do not see a boom or inflationary impulse pushing US Treasurys or other benchmark interest rates meaningfully higher.

Income and yield-bearing securities are currently in high demand. Emerging market debt may be a more attractive asset class as it offers higher yield potential than debt in the US, Europe and Japan. We expect a range-bound US dollar, which would also support local-currency emerging market fixed income performance.

The forward earnings outlook is not robust, but we still expect low-single-digit year-over-year growth across most regions.

Price-to-earnings multiples expanded from very low levels this year. They may rise a bit further now that Fed policy looks more accommodative and long-term yields across the globe have fallen to multi-year lows.

Consensus earnings estimates reflect year-over-year growth in the low-single-digit range for most regions of the world. This earnings growth should keep the expansion intact, even if the pace is slower than that of 2018.

Equity market performance will likely hinge on the outlook for corporate earnings and global growth. The market has priced in a rebound in economic growth in the second half of the year. A positive surprise could drive markets higher, while a disappointment could do the reverse.

US fiscal policy remains a source of uncertainty for corporate decision-makers looking to make capital investments. Clarity on trade negotiations with China and an extended ceasefire on additional tariffs represent potential upside risks to global equity markets.

US-China trade tension is weighing on the global economy. Escalating political conflict may continue at the expense of economic and corporate profit growth.

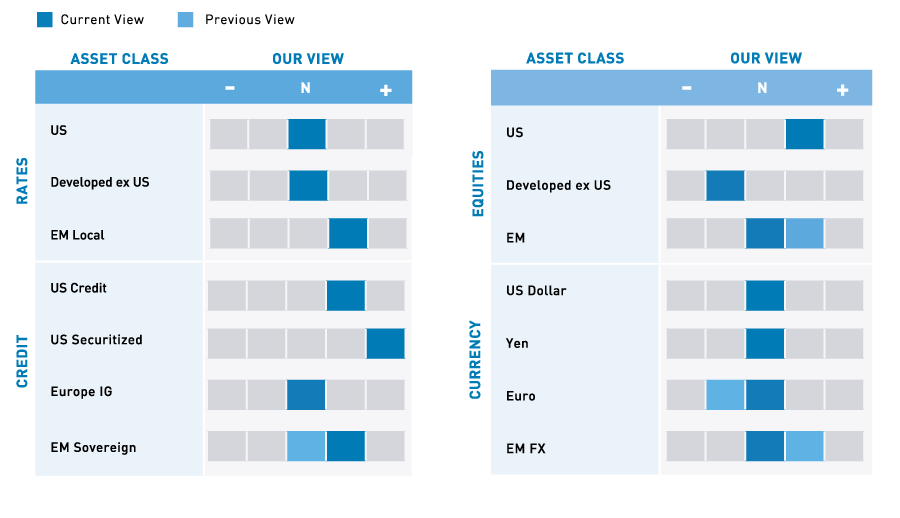

We expect modest total returns, but are watching a number of risk factors.

We believe the probability of a US recession is low. However, consensus estimates for domestic growth could still head lower. We expect US and global economic data to start improving, but progress is not quite underway.

We believe markets are pricing in the risk of modest US-China trade escalation. However, most assets would not respond well if the US backs away from progressive talks at June’s G-20 meeting and imposes 25% tariffs on the remaining ~$300B of US imports from China.

Geopolitical conflict with Iran and other nations increases the risk profile of investing. This, in turn, leads to higher risk premiums as investors demand compensation for the added risk. Credit spreads and equity markets would likely stumble if geopolitical developments worsen.

Corporate earnings drive the credit cycle. Markets have already lowered year-over-year earnings estimates to the low-single-digit range. This leaves little room for further downward revisions before estimates become flat or negative.

Manufacturing PMIs1 are in focus. An uptick in these and other high-frequency economic indicators could go a long way to support investor sentiment and risk assets. For now, US recession and end-of-cycle fears appear overstated. We believe the expansion should continue into next year.

Disclosure

This commentary is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions. There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis do not represent the actual or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but Loomis Sayles cannot guarantee its accuracy. This information is subject to change at any time without notice.

Past performance is no guarantee of future results.

Indices are unmanaged and do not incur fees. It is not possible to invest directly in an index.

Investing involves risk including possible loss of principal.

LS Loomis | Sayles is a trademark of Loomis, Sayles & Company, L.P. registered in the US Patent and Trademark Office.

MALR023788

Loomis, Sayles & Company, L.P. | One Financial Center, Boston, MA 02111 | 800.343.2029

Sitemap | Privacy Policy | Cookie Policy | Important Information