Full Discretion

Our Philosophy

We have a legacy of independent thinking and leaning into the market when others may be pulling away. We take a deep-value, equity-like approach to credit selection across global fixed income markets. Our disciplined process helps gives us confidence in seeking to identify macro trends, formulate a clear view on market sectors, and invest throughout the credit cycle.

For more than 40 years, we have been applying our distinctive style of bond picking to deliver portfolios designed to provide excess yield potential and have low correlations to traditional benchmark-focused fixed income strategies.

The Full Discretion Approach to Credit Selection

During our decades as bond investors, we’ve managed through all sorts of credit conditions. And we have

consistently observed that the market is inefficient at pricing specific risk.

We use repeatable credit selection strategies to capitalize on this persistent inefficiency and drive excess return potential.

.jpg?width=2000&height=1500&name=1antonio-gimenez-RRyDS0Rke2M-unsplash%20(1).jpg)

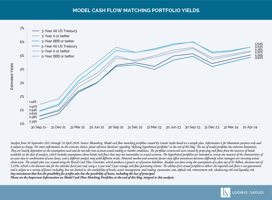

Extra Credit

The Federal Reserve (Fed) appears to be comfortable with the current fundamental backdrop of resilient economic growth, an unemployment rate below its estimate and inflation that continues to decline from its mid-2022 peak. At this point, the Fed is data dependent, noting supply and demand conditions have continued to come into balance, as further incoming data will be required to assess ongoing progress towards the inflation goal. Economic data surprised early in Q1, suggesting that inflation moderation is looking bumpy, coupled with volatile economic activity data and a strong, but moderating, labor market, in our view.

Quarterly Credit Update

Further cooling of inflation and the Federal Reserve (Fed) signaling it was likely done raising rates brought renewed investor optimism in the fourth quarter of 2023. Interest rates fell, the 10-year US Treasury dropped 69 basis points (bps) to finish the year at 3.88%, and broad fixed income markets posted positive returns. Our credit cycle positioning continues to be firmly in ‘late cycle.’

The Case for Strategic Alpha

We believe the flexibility of an unconstrained fixed income strategy can offer investors the ability to achieve multiple investment objectives throughout the course of a cycle

Core Plus Full Discretion: A Differentiated Approach

An extended period of low interest rates and, more recently, an increase in interest rate and spread volatility has investors re-thinking their approach to “core” fixed income strategies.

Full Discretion Team

Range of Institutional Strategies and Mutual Funds

The Loomis Sayles Full Discretion team were among those who pioneered multisector investing with a long-term, flexible, benchmark-agnostic approach. The team manages a range of institutional strategies and mutual funds to help meet different investor needs.

Asset TV Fixed Income Masterclass:

FOMO in Credit Markets

How are corporate fundamentals, demand technicals and discount dollar prices playing out in the investment grade bond market? Portfolio Manager Brian Kennedy weighs in.

Are Conditions Constructive for Credit?

We believe that lower growth and inflation can support credits, but selectivity is key at this phase of the cycle. Learn more from Brian Kennedy, Portfolio Manager and Chris Romanelli, Associate Portfolio Manager and Strategist.

Bank Loans Outlook: On Firm Footing

Investment Director Cheryl Stober shares her team's expectations for defaults, supply/demand technicals and bank loan return potential in 2024.

.jpeg?width=2000&name=1antonio-gimenez-RRyDS0Rke2M-unsplash%20(1).jpeg)

Extra Credit

When it comes to portfolio construction, the Full Discretion team has long employed a combination of bottom-up security selection and top-down, macroeconomic analysis. We utilize a credit cycle framework to evaluate the factors driving the cycle, anticipate broad sector mispricings and seek to take advantage of changes in risk premium at every stage. This process helps us identify the risk drivers we want to emphasize, or seek to avoid, in our portfolios and lays the foundation for our overall risk assessment. Enterprise value is the anchor by which we conduct our bottom-up fundamental analysis.

Core Plus Bond Fund & Investment Grade Bond Fund Highlights

The Full Discretion and Relative Return teams both utilize a credit cycle framework and input from Loomis Sayles research analysts, including credit, securitized and macro, to help inform their respective investment decisions; however, their processes are distinct, resulting in differentiated performance objectives and outcomes.

Rethinking The Fixed Income Playbook For Insurers

The last ten months have shaken the traditional core fixed income playbook. We think it's time to consider a more thoughtful approach to fixed income allocations in insurance portfolios.

In Case You Missed It: A Conversation With Full Discretion's Portfolio Managers

On December 9, 2020, Full Discretion portfolio managers Elaine Stokes, Matt Eagan and Brian Kennedy joined Jim Sia, Head of Relationship Management, for a live call with institutional clients and consultants to discuss Dan Fuss’ step back from portfolio management, the deep investment resources of the Full Discretion team, and the team’s outlook going into 2021.

Credit Check: The Full Discretion Approach To Credit Selection

Credit markets are frequently moving. During our decades as bond investors, we’ve seen them frozen during times of crisis, frothy when investors have seemed desperate for yield, and everything in between.

Matt Eagan's LinkedIn Articles

Explore the deep-dive articles written by Matt Eagan on LinkedIn.

“Covenant-Lite” Loans:

Credit Quality Is Still the Dominant Factor

The Bank Loans Team is often asked about covenant-lite loans. The team shares their views on what they are and are not.Explore More of the Full Discretion Team Members.

Meet the 30 investment professionals whose experience and expertise help drive alpha across Full Discretion strategies

Call it art or call it a philosophy; we consider it to be both. Fundamental research is the cornerstone of everything we do and believe in.

Disclosure

Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the Full Discretion Team only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Market conditions are extremely fluid and change frequently.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Commodity, interest and derivative trading involves substantial risk of loss.

Diversification does not ensure a profit or guarantee against a loss.

Past performance is no guarantee of, and not necessarily indicative of, future results.

MALR030465

6432609.1.1