Views from Loomis, Sayles & Company

Credit Compass: Mapping the Markets as Conditions Evolve

The Surprises of the Past Year

We asked investors and traders about surprises that shaped the markets over the past 12 months. One major theme emerged.

What is the Credit Cycle Telling Us?

The US is currently in a position of economic resilience. Credit spreads are tight, risk appetite remains strong, the Fed has been easing monetary policy and nominal GDP remains in the 4.5%-5.0% range. Our quarterly survey of our credit analysts found that most key fundamentals remain in good shape, and they expect solid earnings growth in 2025.

We expect these factors to support financial conditions and corporate health as we move through 2025, and we believe the credit cycle will continue progressing in mid-to-late expansion.

What the Market Might Be Missing

Our experts tackle current market themes and lay out where they disagree with consensus.

What do you think will be the biggest driver of credit markets in 2025?

Data sourced from a survey of 12 Loomis Sayles investors and traders, as of 10 December 2024.

Charts are shown for illustrative purposes only. Some or all of the information on these charts may be dated, and, therefore, should not be the basis to purchase or sell any securities. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the 12 investors surveyed, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

Squeezing Juice Out of the Credit Markets

Our experts break down the dynamics they think will drive credit markets in 2025.

Priced for Perfection? Weighing the

Major Risks of 2025

Our investors and traders sound off on the risks that could shake global financial markets in 2025.

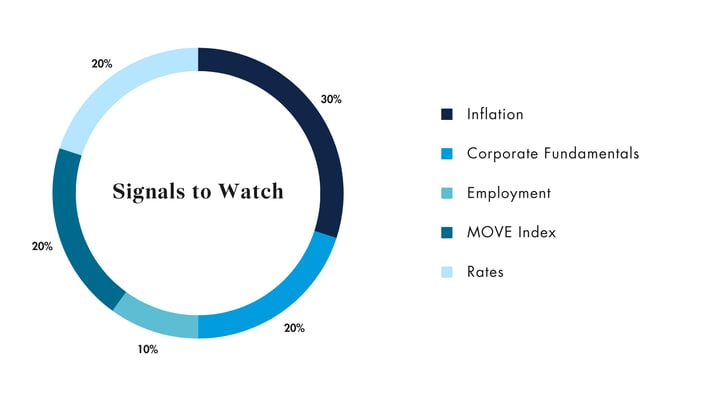

What indicator are

you most focused on?

Data sourced from a survey of 12 Loomis Sayles investors and traders, as of 10 December 2024.

Charts are shown for illustrative purposes only. Some or all of the information on these charts may be dated, and, therefore, should not be the basis to purchase or sell any securities. Information obtained from outside sources is believed to be correct, but Loomis Sayles cannot guarantee its accuracy.

Any opinions or forecasts contained herein reflect the current subjective judgments and assumptions of the 12 investors surveyed, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. This information is subject to change at any time without notice.

A Big-Picture Understanding of Corporate Health

The Loomis Sayles Corporate Health Index (CHIN) provides a view of credit markets, integrating the fundamental with the macro to help identify factors that others might be missing or ignoring.

Enabling Early Detection in the Credit Markets

The Loomis Sayles Credit Analyst Diffusion Indices, or CANDIs, open up channels of communication to help us detect outliers and trends in the credit markets just as they emerge.

Disclosure

Scott Darci, Matt Eagan, Chris Gudmastad, Elaine Kan, Steve LaPlante and Lynda Schweitzer filmed their comments on 18 December 2024. Jack Celata, Elisabeth Colleran, Devon McKenna, Rick Raczkowski, Preston Raymond and Patrick Savery filmed their comments on 19 December 2024.

This marketing communication is provided for informational purposes only and should not be construed as investment advice. Any opinions or forecasts contained herein, reflect the subjective judgments and assumptions of the authors only, and do not necessarily reflect the views of Loomis, Sayles & Company, L.P. Investment recommendations may be inconsistent with these opinions.

There is no assurance that developments will transpire as forecasted and actual results will be different. Data and analysis does not represent the actual, or expected future performance of any investment product. Information, including that obtained from outside sources, is believed to be correct, but we cannot guarantee its accuracy. This information is subject to change at any time without notice.

Commodity, interest and derivative trading involves substantial risk of loss. This is not an offer of, or a solicitation of an offer for, any investment strategy or product.

Any investment that has the possibility for profits also has the possibility of losses, including the loss of principal.

Markets are extremely fluid and change frequently.

Past market experience is no guarantee of future results.

SAIF8lzmd7jl